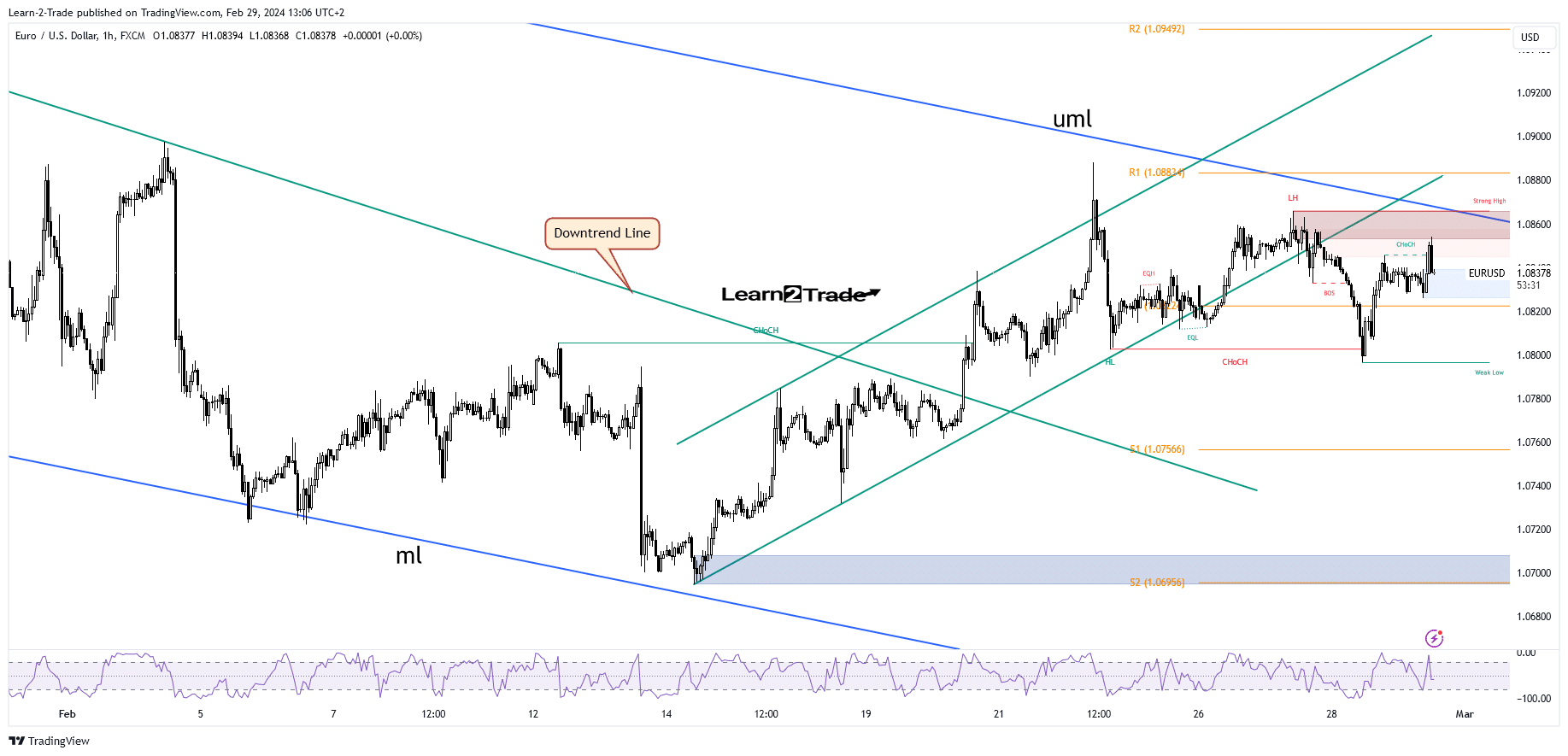

- The bias is bearish as long as it stays below the upper median line.

- The US economic data should bring strong action.

- Escaping from the up channel signaled a new leg down.

The EUR/USD price is trading at 1.0838 at the time of writing. The pair looks positive to approach new highs as the US dollar remains weak.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The greenback depreciated as expected because the US Prelim GDP and Goods Trade Balance came downbeat in the last trading session.

Today, the German Retail Sales reported a 0.4% drop, even though the traders expected a 0.5% growth, while the German Unemployment Change came in better than expected, at 11K above 6K estimated. The German Prelim CPI should be released today as well.

Later, the US economic figures should have a big impact. The Core PCE Price Index may announce a 0.4% growth after the 0.2% growth expected.

Unemployment Claims could jump from 201K to 209K, Chicago PMI could be reported at 48.1 points, above 46.0 points in the previous reporting period, while Pending Home Sales could announce a 1.4% growth in January after an 8.3% growth in December.

In addition, Personal Spending and Personal Income data will be published as well.

EUR/USD Price Technical Analysis: Bullish Momentum

From a technical point of view, the EUR/USD price rose after the last strong sell-off. In the short term, a minor rebound was natural.

The price has climbed as much as 1.0854, where it has found a strong supply. As you can see on the hourly chart, the price escaped from the up channel pattern, indicating a new leg down.

–Are you interested to learn more about forex signals? Check our detailed guide-

It has retested the supply zone below 1.0860 and under the descending pitchfork’s upper median line (uml). The pair could drop again if it stays below the upper median line (uml). Taking out this dynamic resistance confirms further growth.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.