- The dollar is gaining ground as traders prepare for the outcome of the FOMC policy meeting.

- Markets expect the Fed to hold rates at Wednesday’s meeting.

- Data on Tuesday revealed a significant decline in Canada’s inflation.

The USD/CAD price analysis is bullish on Wednesday, with the greenback on the front foot ahead of the FOMC meeting. Meanwhile, the Canadian dollar faces headwinds as recent data exposed a notable slump in inflation.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

Markets expect the Fed to hold rates at today’s meeting. At the same time, there is speculation that policymakers will push back expectations for rate cuts after the recent hot inflation figures.

Consequently, the dollar has remained steady since last week. Additionally, investors have scaled back expectations for the first cut in June. Bets fell significantly after Goldman Sachs said it expected 3 Fed cuts this year, down from 4. As a result, the chances of a cut in June fell below 50%.

Meanwhile, the situation in Canada is quite different. Data on Tuesday revealed a significant decline in inflation. Notably, annual inflation fell to 2.8% while core figures hit a 2-year low. This was a big divergence from the US. After the report, the chances of a June cut by the Bank of Canada rose from 50% to 75%.

Canada’s economy is weakening. Therefore, if the BoC delays cuts beyond June, it could further hurt the economy. However, if they cut before the Fed, it could significantly weaken the Canadian dollar and negatively impact the economy.

USD/CAD key events today

- Federal Funds Rate

- FOMC Economic Projections

- FOMC Statement

- FOMC Press Conference

USD/CAD technical price analysis: Bearish engulfer signals a reversal

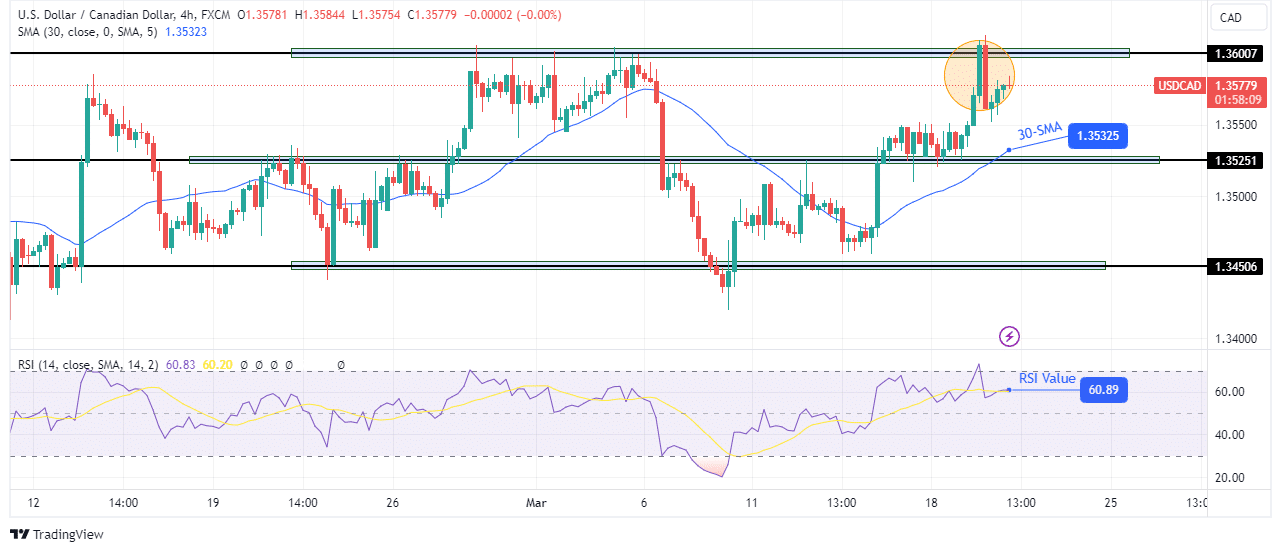

On the technical side, the bias for USD/CAD is bullish as the price has risen to retest the 1.3600 key resistance level. At the same time, it trades well above the 30-SMA with the RSI above 50, a sign that bulls are in the lead. Bulls took control when the price failed to trade below the 1.3450 key support level. They pushed above the 30-SMA and the 1.3525 resistance, making higher highs and lows.

-Are you interested in learning about the forex signals telegram group? Click here for details-

However, price action at the 1.3600 key level shows that bears might take over soon. The price has made a bearish engulfing candle that could lead to a break below the 30-SMA to retest the 1.3450 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.