- The core PCE price index showed inflation rising by a smaller 0.3%.

- Markets raised the chances of a Fed rate cut in June from 57% to 68.5%.

- The ECB’s Yannis Stournaras called for 100 bps in interest cuts this year.

Today’s EUR/USD forecast gleams with bullish optimism as the dollar weakens, triggered by the anticipated decline in the Fed’s preferred inflation gauge. This decline fueled speculation of potential Fed rate cuts.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Notably, the core PCE price index showed inflation rising by 0.3%, a decline from the previous reading of 0.5%. As a result, markets raised the chances of a rate cut in June from 57% to 68.5%. At the same time, market participants expect 75 bps in interest rate cuts this year. After the report, Fed Chair Jerome Powell noted that inflation was similar to what the central bank wanted to see.

From here, investors will now focus on the jobs report for March. A resilient economy will likely see the Fed maintain its current outlook on rate cuts. On the other hand, if jobs miss forecasts, there might be more pressure to cut rates, leading to an increase in rate cut expectations.

Meanwhile, ECB’s Yannis Stournaras called for 100 bps in interest cuts this year in the Eurozone. This would translate to four rate cuts, putting the ECB in a more dovish position than the Fed. Moreover, he noted that the ECB did not have to wait for the Fed to start cutting rates. A more dovish ECB would lead to a decline in EUR/USD. Still, markets expect the Fed and the ECB to start cutting interest rates in June.

EUR/USD key events today

- US ISM Manufacturing PMI

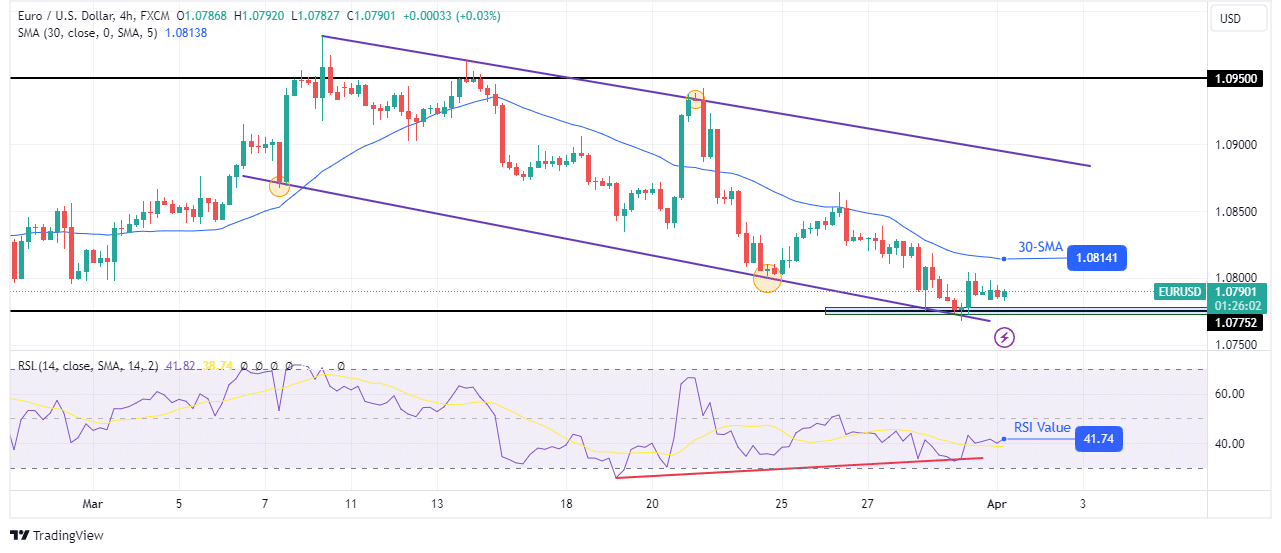

EUR/USD technical forecast: Price finds respite, halts decline at 1.0775 support

On the technical side, the EUR/USD decline has paused at the 1.0775 support level. The price sits below the 30-SMA, making the bias bearish. At the same time, the RSI trades in bearish territory below 50. The price has been in a downtrend since it found solid resistance at the 1.0950 key level. Moreover, it has traded in a bearish channel.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

However, bears have grown weaker despite making lower lows. The RSI has made a bullish divergence that could soon lead to a reversal. Bulls will take over when the price breaks above the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.