- The US released data showing a slowdown in services growth.

- The non-manufacturing PMI fell from 52.6 in February to 51.4 last month.

- In March, Eurozone inflation fell to 2.4% from 2.6% the previous month.

The EUR/USD forecast reveals bulls leading as the dollar falters on signs of inflation relief. Moreover, the EUR/USD pair has gained despite increased rate cut expectations in the Eurozone.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

On Wednesday, the US released data showing a slowdown in service growth. This is a relief for the Fed as it indicates a moderation in inflation. Consequently, investors increased their bets that the central bank will start lowering interest rates in June.

The non-manufacturing PMI fell from 52.6 in February to 51.4 last month. Although the sector is still in expansion, it has slowed down. Inflation in the service sector has been a major pain point for most central banks. Although headline inflation has eased significantly, services inflation is falling at a much slower pace as demand remains high.

On Friday, the US will release the nonfarm payrolls report, showing the state of employment. This report will greatly affect rate-cut bets if it comes below or above forecasts.

In the Eurozone, data on Wednesday revealed a big drop in headline and underlying inflation. In March, inflation fell to 2.4% from 2.6% the previous month. This gives the European Central Bank enough reason to start cutting interest rates in June. However, analysts believe some policymakers will remain cautious as services inflation remains high at 4%.

EUR/USD key events today

- US unemployment claims

EUR/USD technical forecast: Bulls take the lead with solid momentum

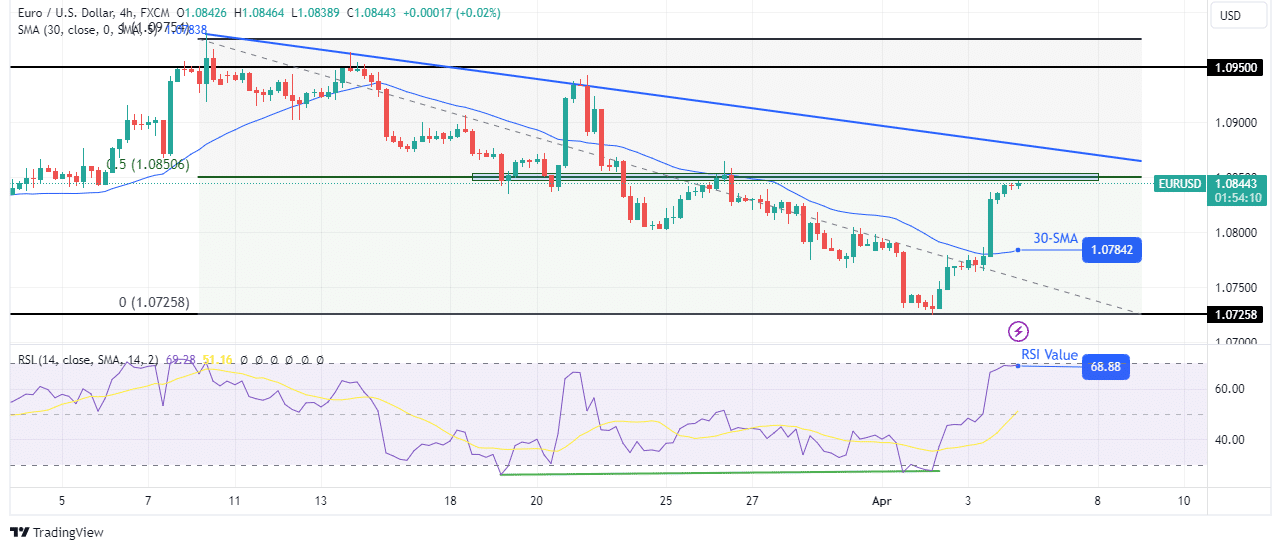

On the technical side, the EUR/USD price has risen sharply, breaking above the 30-SMA. This rally has led to a shift in sentiment from bearish to bullish. Furthermore, there was a surge in bullish momentum when the RSI rose to trade slightly below the overbought region. The shift came after the RSI made a slight bullish divergence.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

However, the price is approaching a strong barrier comprising the 0.5 Fib level and the 1.0850 key resistance. Additionally, there is a resistance trendline above this area that might halt the bullish move. If the price pauses, it could pull back to retest the 30-SMA support. However, if bullish momentum surges, it might break past these resistance levels to make new highs and confirm a bullish reversal.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.