- The bias remains bullish, so further growth is natural.

- Taking out the resistance levels activates further growth.

- The US data should bring sharp movements tomorrow.

The EUR/USD price is struggling hard to resume its rally. The pair is trading at 1.0859 at the time of writing, below today’s high of 1.0865. The bias is overall bullish, so further upside remains possible as the US dollar is under downside pressure.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Yesterday, the German Industrial Production and the Eurozone Sentix Investor Confidence came in better than expected, while the German Trade Balance was disappointed.

Today, the US will release the RCM/TIPP Economic Optimism and the NFIB Small Business Index, but these are low-impact events. Still, the price could print strong moves ahead of the US inflation figures.

The CPI m/m may report a 0.3% growth in March. CPI y/y is expected to register a 3.4% growth, while the Core CPI could announce a 0.3% growth. Stronger data should boost the USD as the FED could maintain the monetary policy unchanged in the next meetings.

On the contrary, lower inflation may weaken the greenback. Also, the US will release the FOMC Meeting Minutes report, representing a high-impact event. Due to uncertainty, the EUR/USD pair could experience sharp movements in both directions.

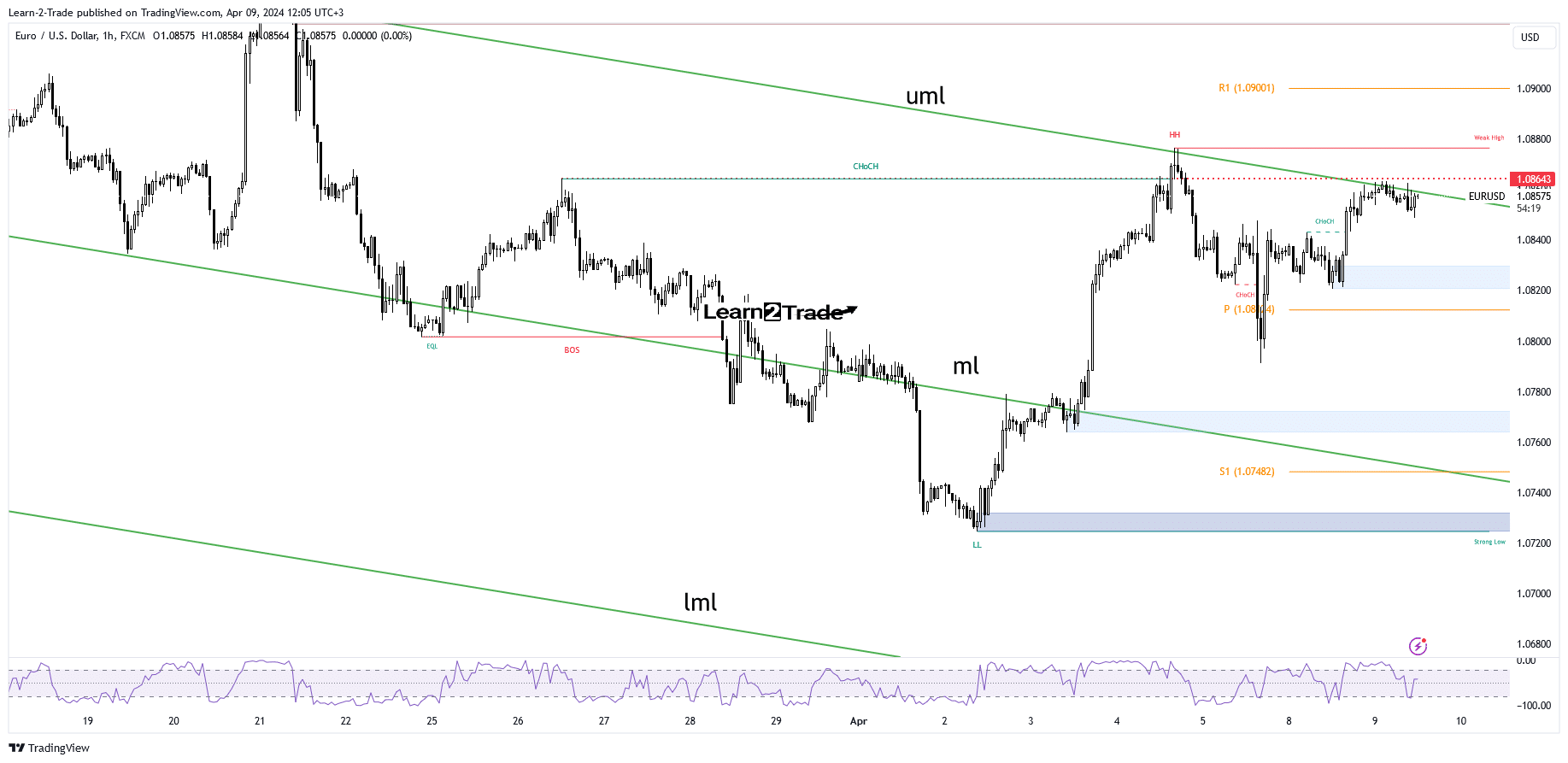

EUR/USD Price Technical Analysis: Bullish Bias

Technically, the EUR/USD price ended its temporary retreat. Now, it challenges the descending pitchfork’s upper median line (uml). This represents a dynamic resistance, so staying near indicates an imminent breakout.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The former high of 1.0865 stands as a static resistance. Taking out the immediate resistance levels and making a new higher high may activate more declines. On the other hand, new false breakouts should precede a new sell-off, at least towards the weekly pivot point of 1.0812.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.