As widely expected, the Bank of Canada left the interest rate unchanged at 0.50%, above the post-crisis low of 0.25% and above the “lower bound” of -0.50%

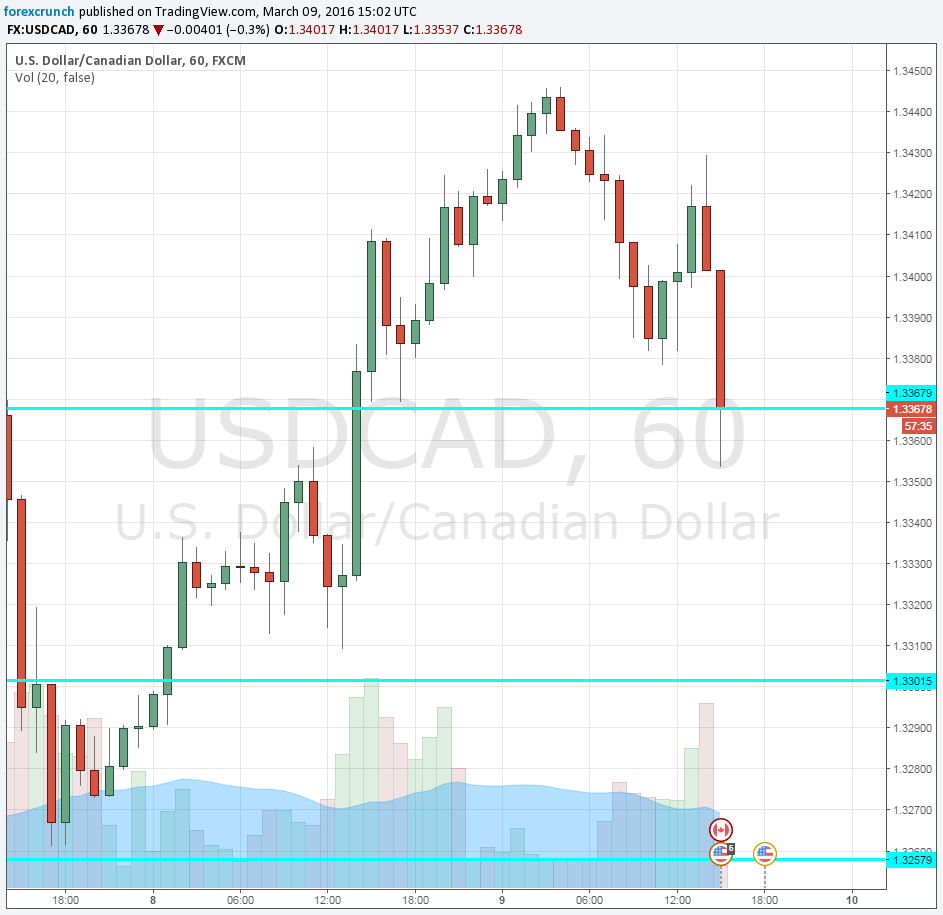

USD/CAD slides quite a lot from from above 1.34 before the publication to under 1.3365 afterwards.

Update: the falls extend towards the round level of 1.33, with the pair hitting a low of 1.3309. This comes after crude oil inventories showed yet another build, but gasoline and distillates continued falling – the withdrawals in finished products are supportive of oil prices (WTI gets close to $38) and the Canadian dollar plays along.

The BOC sees the recent rise in CAD as normal and going along with the change in oil and also in the change in policy expectations. Back in January, the BOC surprised most market analysts as they refrained from cutting rates.

At the moment, the BOC does not seem surprised with recent developments: this is what they had assumed back in January. The outlook remained unchanged. In general, the developments in the US economy, inflation in Canada and risks are all in line.

The general message is: everything is alright.

This is quite good news for the Canadian dollar.

The Canadian dollar came off the highs in recent days, following a parallel slide in oil prices. Crude oil inventories are due at 15:30 GMT, exactly 30 minutes after the release from the BOC.

Here is the chart showing the slide in Dollar/CAD. The move persists: