No surprises from the Bank of Canada: the interest rate was left unchanged at 0.50% once again. After the government introduced fiscal stimulus as expected, the BOC has no need to add monetary stimulus.

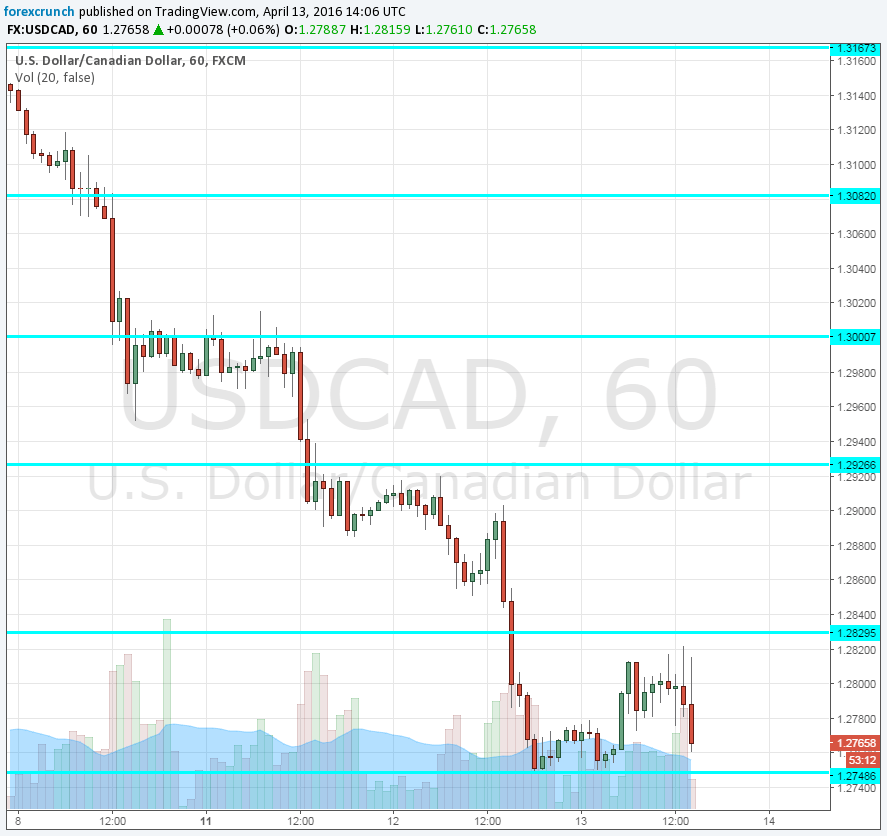

Forecasts seem slightly more upbeat, allowing the Canadian dollar to hold up against the USD and even gain some ground, making a move on 1.2750. The Canadian dollar is also showing strength against the euro, pound and yen, which are all sliding against the greenback.

The team led by Governor Poloz raised growth forecasts from 1.4% to 1.7% in 2016 and marginally revised the prediction for 2017 from 2.4% to 2.3%. They also say that the output gap could be closed earlier than expected: in the second half of 2017 and not necessarily at the very end of the that year.

Risks to inflation are seen as balanced and they are also optimistic about the US economy, as a destiny for Canadian exports.

Earlier, US data did not look too great: retail sales badly disappointed and this raised concern about a recession. However, after the initial wobble, the US dollar came on top.

For the loonie, the focus returns to oil prices, with crude oil inventories and the upcoming OPEC – Non-OPEC meeting coming up next.

More: USD/CAD: Undervalued By More Than 5%; Where To Target? – Nomura

USD/CAD chart: