The former UK colonies are feeling some market love following fresh polls showing a break towards Bremain. The polls by Ipsos Mori and Populus show a victory for staying in the EU. The release of these polls on the day of the vote joins one released beforehand.

Commodity currencies are “risk currencies” – they rise when the mood improves and it has certainly improved. It also means that they could fall even harder in case of a Brexit. It seems that some kind of a correction is already underway.

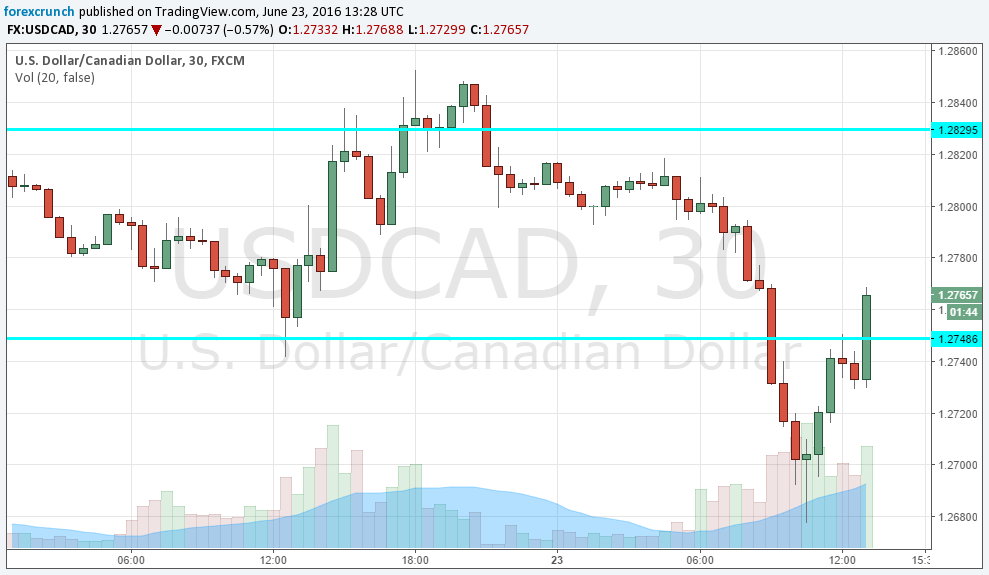

USD/CAD dips under support

The Canadian dollar also enjoys better oil prices to rise to higher ground. USD/CAD dipped under 1.2750 all the way to 1.2677, but made its way back up to 1.2767 at the time of writing – a sharp correction. Oil prices are more stable around $50.

Support awaits at 1.2630, followed by 1.25. Resistance is at 1.2830 and 1.2910.

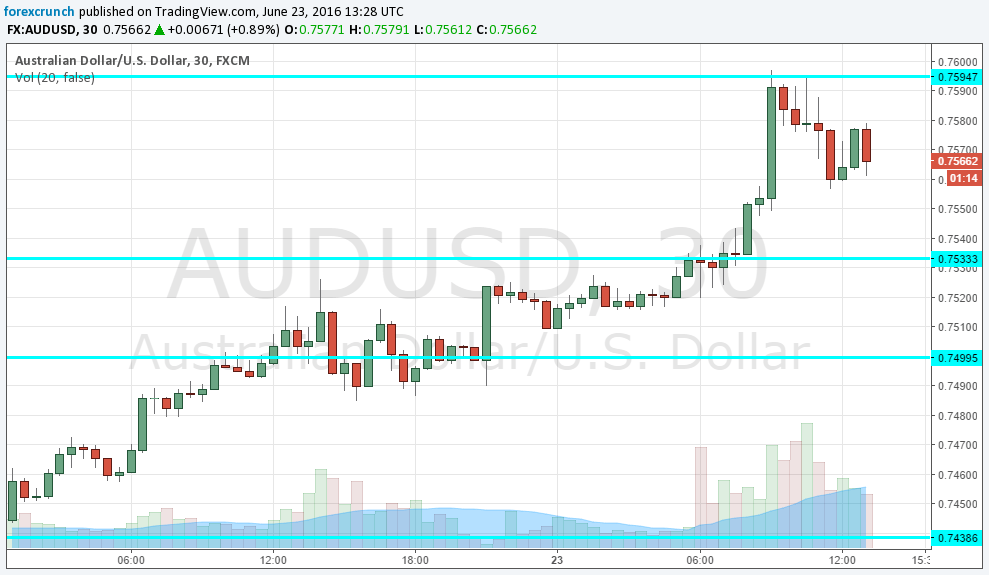

AUD/USD hits round resistance

The Australian dollar made a nice move up all the way to 0.76, a line of resistance, but is slipping back down.Nevertheless, it is showing more resilience than the C$ and maintains the highs of 0.7572 as the RBA is not set to cut rates anytime soon.

Further support is at 0.7533 and 0.7440. Higher resistance is at 0.7740 and 0.7840.

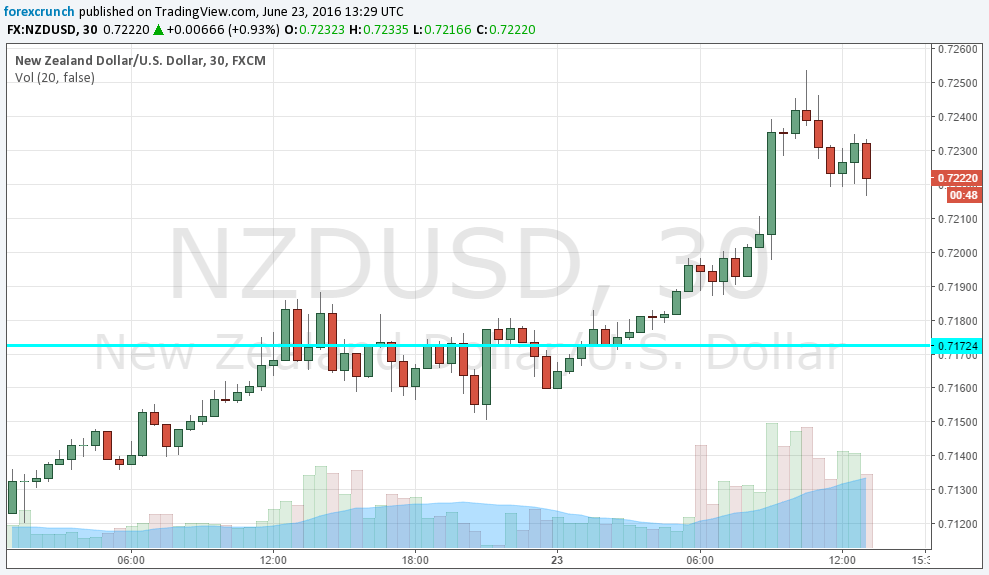

NZD/USD looks unstoppable

Since the RBNZ signaled it is in no hurry to cut rates, the kiwi seems to enjoy the good mood and not suffer too much from the bad mood. The pair advanced all the way to 0.7250 and slipped back only to 0.7220, not such a huge correction.

0.7170 works as support, with 0.7050 further down the road. Resistance is at 0.75.

More: