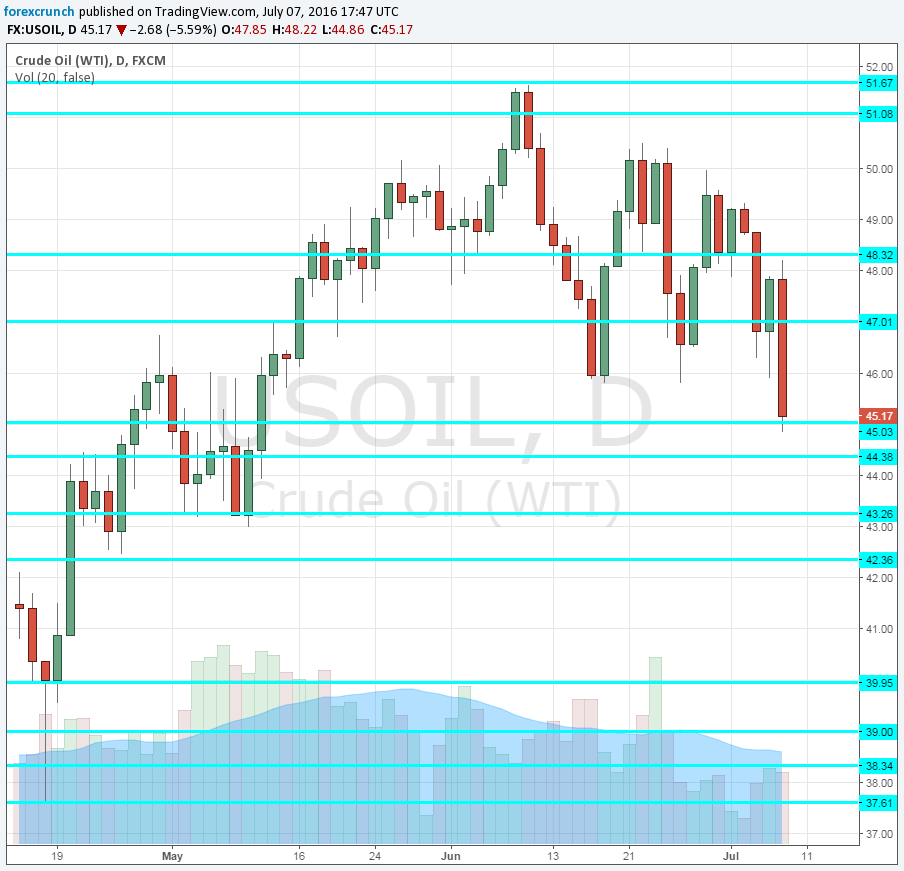

WTI Crude Oil is trading at $45.20, the lowest level since mid -May and a drop of 5.5%. It already reached a low of $44.86. The big slide is a mix of risk-off related to Brexit as well as the release of Crude Oil Inventories, which released the sellers. The report in itself showed a draw from oil reserves, more or less as expected. However, it seems that sellers were itching to move on ahead of tomorrow’s NFP.

Here is the daily chart of WTI, showing the big fall out of range:

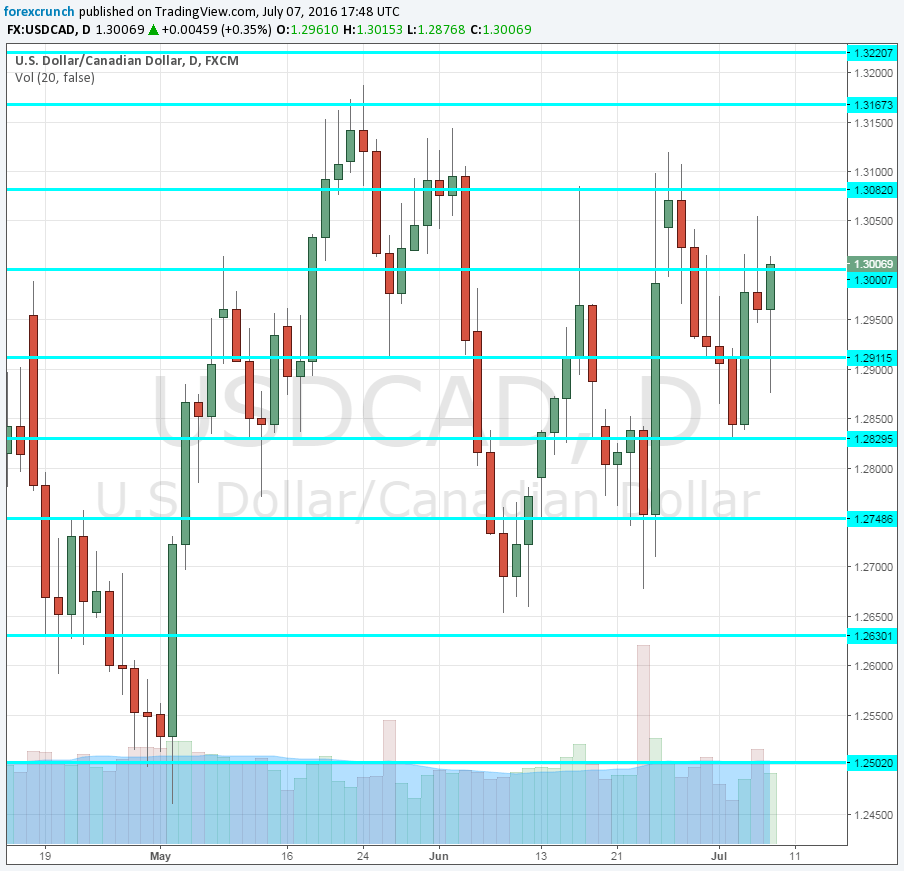

Moving to USD/CAD, we do not see the same picture. USD/CAD remains trading around 1.30, the magnet that has attracted the price for a long time. Dollar/CAD is very much in range.

It is slightly higher, 50 pips or 0.4%, but this is far from being a significant move. This is a sign of strength of the Canadian dollar. So, tomorrow we will get both the US and the Canadian jobs report. The US Non-Farm Payrolls always gets more attention.

However, CAD could be interesting. Assuming the current trend continues, USD/CAD could brush off a weak report, while a strong gain in Canadian jobs could send the pair crashing – CAD soaring.

A lot of strength in the loonie at the moment: