The world’s second-largest economy enjoyed solid economic growth at an annualized level of 6.9%, better than 6.8% expected. In addition, industrial output increased by 7.6%, much better than 6.5% expected.

Australia exports metals to China, metals which are used in industry and in housing. In theory, the good news should help the Australian dollar.

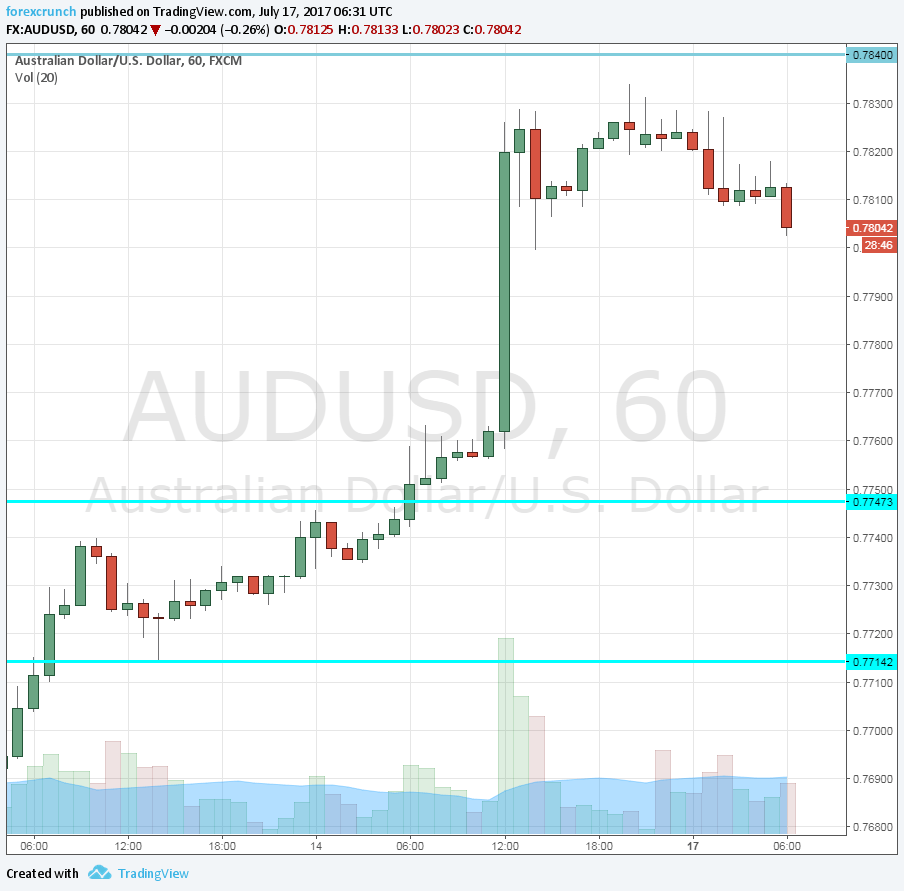

AUD/USD was edging closer to critical resistance at 0.7835, the cycle high. The poor figures from the US helped the Aussie extend its gains on Friday.

But perhaps the pair’s rise is somewhat over-extended. Instead of pushing higher, AUD/USD is taking a break from gains and is actually lower, trading just above 0.78.

One reason is that the greenback is correcting across the board, making some gains against other currencies as well. Another reason is that the Australian dollar does not have a hawkish central bank to back it.

The ECB is set to taper, the BOE is considering raising rates and the BOC just hiked and intends to do more. In Australia, the RBA recently showed a reluctance to move.

Later this week, Australia publishes its jobs report, and a positive outcome could unleash the upside.