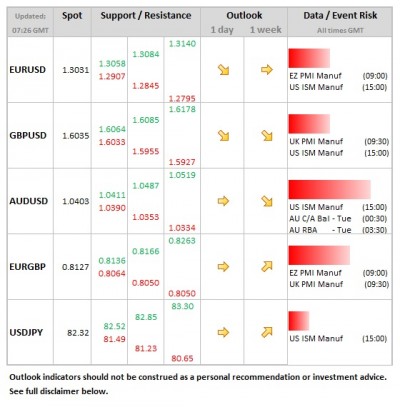

Data/Event Risks

- GBP: The manufacturing PMI data has fallen for the past two months, so sterling should take some comfort if data is stronger than expected (48.0, last 47.5).

- EUR: Focus on final PMI data today, but this is only low event risk as only a revision to preliminary numbers, but worth keeping an eye on. Finance ministers meet today, so beware for comments.

- AUD: RBA rate decision overnight, with 25bp cut almost fully priced in, so this would likely lead to only limited reaction. A 50bp cut and retention of easing bias would see AUD weaker into the 1.0300/50 area.

Idea of the Day

In essence, this is going to be a different December, with the fiscal cliff’s shadow hanging over markets. What was interesting during Friday’s session was the fact that the yen held relatively steady during what was a last day of the month. Furthermore, the dollar was struggling when concerns over the fiscal cliff were rising, so the belief that the dollar could gain as the negotiations stall (on ‘risk-off’ sentiment) is looking weak at present. EUR/JPY continues to look interesting, making a 7mth high on Friday. A closing break above 108.00 would place the 111.44 year high into sight, but that would require renewed pressure against the yen, which may have to wait until after the election result mid-month.

Latest FX News

- USD: The grand-standing around the fiscal cliff shows both sides retaining their entrenched positions with no signs of compromise. The dollar implications are becoming less clear as the market struggles to buy the dollar on a ‘risk-off’ strategy – at the same time that the country is heading for a fiscal car crash.

- EUR: German Chancellor Merkel suggesting that in time, Greece could see some of its debts written-off. Comments reported in Bild newspaper, but caveat is it could only happen once budget is on sustainable footing.

- JPY: Weekly CME data showing yen shorts at highest for several years, keeping risks of further down-moves in USD/JPY as short yen positions are covered.

- AUD: Retail sales data on the soft side, holding flat in October, having risen by a month average of 0.3% over the past year. AUD falling for 3rd consecutive day on the back of the release, which cemented view that RBA will cut rates on Tuesday.

- GBP: House price data overnight (Hometrack) showing holding in negative territory at -0.3% YoY. Focus turning to Wednesday’s Autumn Statement from the Chancellor, in which further fiscal demands are expected to be imposed on the economy.

- CNY: Various purchasing managers’ data released over the weekend and today, all showing modest increases and offering further comfort to the view of a controlled soft landing in China.