Euro/dollar has advanced but seems very hesitant and shies from significant lines of resistance.

According to some data, the pair should have already reached beyond 1.20. Morgan Stanley explains:

Here is their view, courtesy of eFXnews:

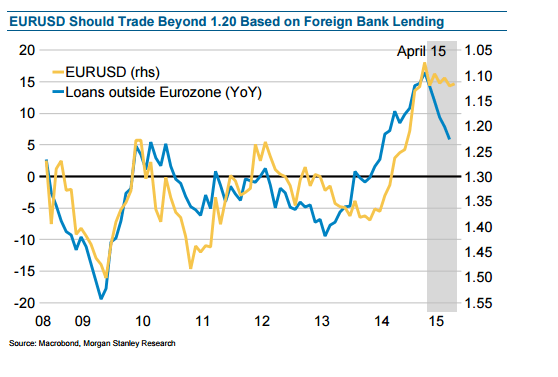

In a note to clients, Morgan Stanley presents the exhibit below comparing the evolution of European banks’ foreign asset holdings and EUR/USD.

“While there had been a tight correlation between the two data series, EURUSD currently trades at a significant discount to banks’ foreign credit lending. According to this guide, EURUSD should trade beyond 1.20,” MS argues.

“The reason why EURUSD trades at the lower level is due to ECB expectations. For EUR to trade at current discounted levels requires the ECB to threaten easing further with the hope of easier ECB conditions pushing EUR bond yields down to a level where foreign demand for EUR-denominated funding rises again.

Yes, EUR would maintain its risk component with better risk appetite, suggesting a lower EUR and vice versa. However, sharply falling demand for EUR loans may also be related to relative costs of credit. In March, EUR loans were more attractive than today, with bond yields 50bp higher,” MS adds.

MS targets EUR/USD at 1.13 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.