Speculation continues mounting is the UK will indeed leave the EU or that there will be a regret on Brexit – Bregret or if you wish, an EU-turn or a Breturn. This big event is already taking its toll on the economy, but provides growth in new words.

We explained how nobody wants to push the Brexit Button and invoke Article 50 – the formal announcement to leave the union. With every day that passes by, the economy suffers more and public opinion may sway towards staying in. And with every day that passes without A50, speculation mounts it will never happen.

In the next 24 hours, the Conservative Party will have all its candidates laid out. Cameron’s heir is seen as Boris Johnson, leader of the Brexit campaign, but it may also be Theresa May, the minister of interior and a member of the Bremain camp. If May is elected on September 9th, or while she still has a good showing in polls, markets could speculate that the move could be reversed.

But also if Johnson wins, there are doubts that he will push through with Brexit. His move to jump on the Brexit bandwagon was also seen as a cynical move to stand out as a prominent politician. In addition, his somber look on Friday showed he was worried: worried about pulling the trigger, worried about a recession and worrying that all the blame will fall upon his head.

The chances for a a full reversal seem low, but an EU exit in name only is certainly a possibility. The UK could remain out of the EU but still obliged to follow the free movement principal, the EU regulation and enjoy the single market. It will only lose its say in decision making. This is exactly the Norwegian model.

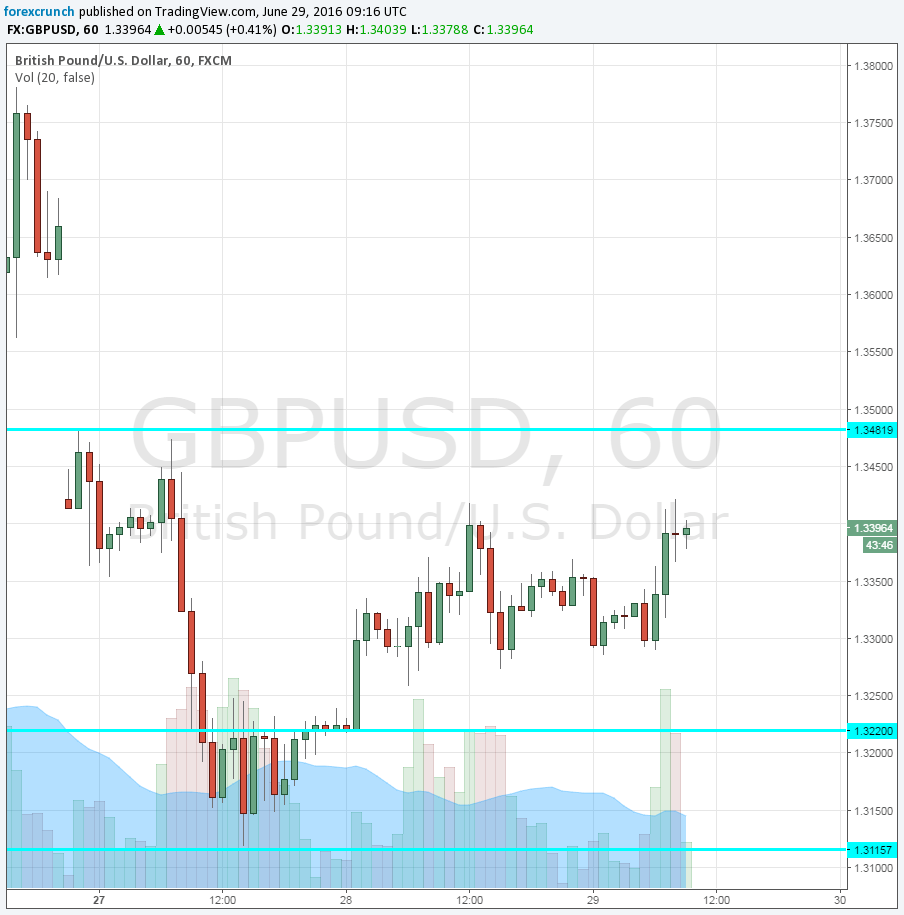

GBP/USD enjoys a second day of rises after a devastating plunge on Friday and another big fall on Monday.Yesterday’s bounce was big and now we are seeing some continuation.

GBP/USD is trading around 1.34 after having reached 1.3480. It still hasn’t closed the weekend gap and remains under Monday’s high of 1.3480. However, it is off the lowest levels seen on Friday at 1.3230 and at least looks more stable.

More: Brexit – all the updates

Here is the GBP/USD chart: