EUR/USD dipped to the lower ground on the Turkish crisis but recovered on a relief in the crisis and as China and the US decided to talk again. The ECB Meeting Minutes stand out this week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Turkish crisis sent the Lira down and weighed heavily on the euro, sending EUR/USD to the brink of 1.1300. Euro-zone banks are exposed to Turkey and fears of contagion hurt also floated. After the authorities took some measures and Qatar offered some loans, the situation stabilized. In addition, China and the US decided to resume trade talks, improving the atmosphere and sending the US Dollar down. German GDP surprised with 0.5% in Q2 and upgraded the euro-zone GDP score to 0.4%. In the US, retail sales surprised to the upside but with some downward revisions.

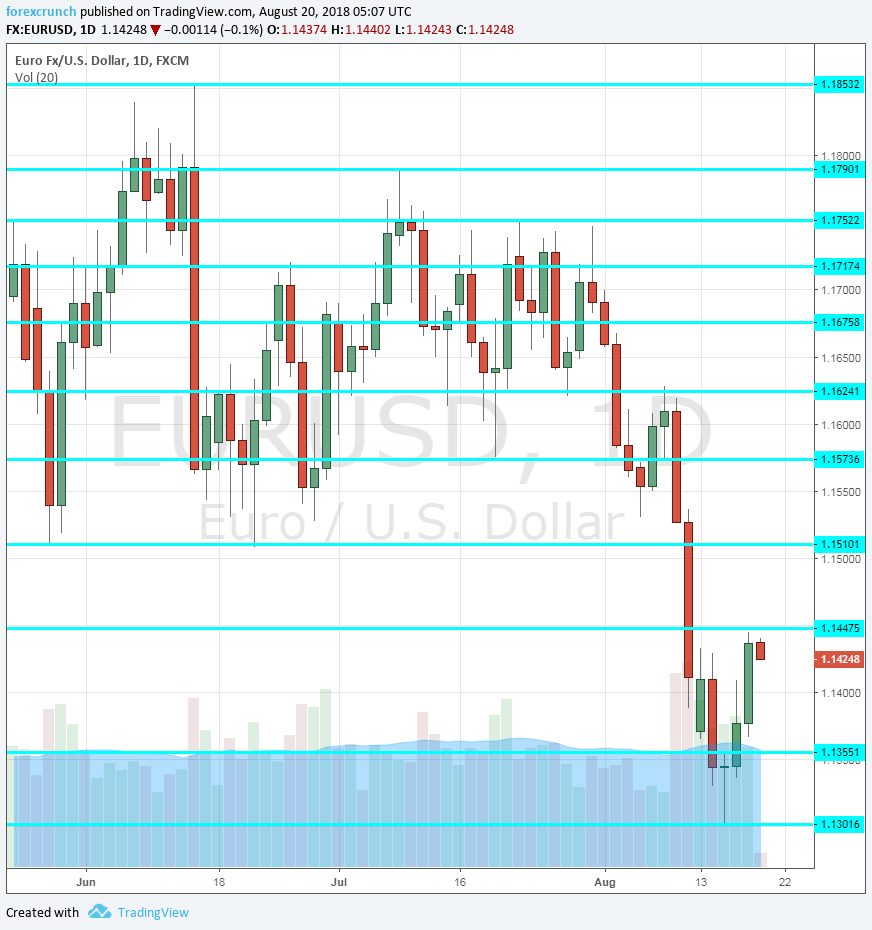

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Flash PMI data: Thursday morning: 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. Markit’s forward-looking purchasing managers’ index for the French manufacturing sector for July showed a score of 53.3 points, slightly above the 50-point threshold that separates expansion from contraction. A score of 53.5 is expected in the preliminary report for August. The French services sector had 54.9 points and is now expected to show 55.1 points. Germany’s manufacturing PMI stood out with a robust score of 56.9, albeit below previous levels. A drop to 56.6 is on the cards now. Germany’s services PMI carries expectations for an increase from 54.1 to 54.4 points. The euro-zone manufacturing PMI is forecast to remain unchanged at 55.1 and the services PMI to rise from 54.2 to 54.4 points.

- Jens Weidmann talks: Thursday, 7:30. The President of the German central bank, the Bundesbank, will speak in Berlin and may provide his opinions on the next moves by the Bank, the latest rise in inflation, the uncertainty about trade, and more.

- ECB Meeting Minutes: Thursday, 11:30. The European Central Bank maintained its dovish stance in its July meeting. President Mario Draghi clarified that the Bank will not raise rates before September 2019, putting an end to speculation that an increase may come earlier. The Frankfurt-based institution is also worried about tariffs. The meeting minutes will reveal more information about their way of thinking and if they have become more optimistic about inflation or worried about growth and trade. The stance will likely be somewhat dovish, but this is priced in.

- Consumer Confidence: Thursday, 14:00. The official consumer confidence measure from Eurostat stood at -1 in July. The 2.300-strong survey is now projected to remain at the same level for August.

- German GDP: Friday, 6:00. The initial read of German GDP for Q2 2018 surprised with an increase of 0.5%, better than had been expected and pushing the overall figure higher. The final read is expected to confirm the preliminary one.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar initially dropped and hit the 1.1300 level (mentioned last week). It then recovered swiftly.

Technical lines from top to bottom:

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

1.1625 provided support to the pair several times in June and July. It is followed by the mid-July trough of 1.1575.

Below, 1.1508 is the previous 2018 low. 1.1450 capped the pair back in June 2017 and also in mid-August.

1.1355 was a pivotal line when the pair traded at low ground mid-August. Even lower, 1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

1.1115 was a low point also in that period of time. The very round level of 1.10 is next.

I remain bearish on EUR/USD

As the dust settles from the Turkish crisis, the basic facts have not changed: the European Central Bank is hesitatnt while the Fed is hawkish. This could turn the recent rise to a dead-cat bounce, a correction but nothing else.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!