EUR/USD advanced on the dovish Fed decision but could not hold its higher ground. What’s next? Various surveys stand out in the first full week of February. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Federal Reserve decided to pause the rate hike cycle and now ledges patience. The move was accompanied by an openness to modifying the balance sheet reduction program. Markets cheered and the US Dollar tanked. However, this did not last for too long. The old continent has troubles of its own: Italy is officially in recession, German retail sales plunged, and even the German central bank is now willing to ease the normalization process. A slight uptick in euro-zone core inflation did not help too much. The US Non-Farm Payrolls beat expectations and despite upwards revisions, they kept supporting the US Dollar. All in all, the US Dollar finds it hard to fall despite a dovish shift by the central bank.

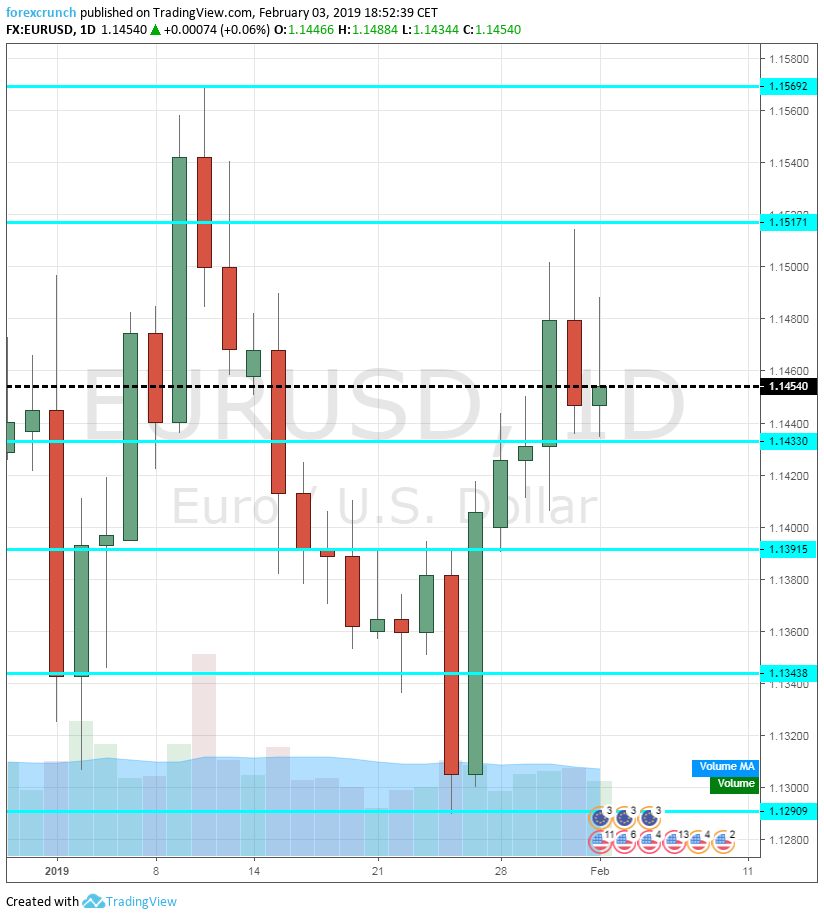

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Unemployment Change: Monday, 8:00. The fourth-largest economy in the euro-zone continues suffering from high unemployment and the fresh indicator for January may provide insights into the situation. After a drop of 50.6K in December, an increase of 60.3K is on the cards for January.

- Sentix Investor Confidence: Monday, 9:30. This broad survey of around 2,800 analysts and investors is in negative territory in the past two months. It is expected to pick up from -1.5 to -1.1 in February, reflecting ongoing pessimism.

- PPI: Monday, 9:00. Producer prices feed into consumer prices. Falling energy prices are projected to send the PPI lower once again: 0.7% down after 0.3% beforehand.

- Services PMI: Tuesday morning: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and the final euro-zone number at 9:00. Spain continued enjoying slow growth in the services sector according to Markit’s forward-looking survey. A slide from 54 to 53.1 is expected for January. Italy, the third-largest economy, is projected to see a drop from 50.5 to exactly 50, the threshold that separates expansion from contraction. The preliminary release for France came out at 47.5 points in January, pointing to contraction. Germany had a score of 53.1 and the whole euro-zone 50.8. The final read will likely confirm the initial figures.

- Retail Sales: Tuesday, 10:00. Consumers increased their spending by 0.6% in November but the volume probably decreased in December. A slide of 1.5% is on the cards. The data is driven lower by Germany’s poor outcome.

- German Factory Orders: Wednesday, 7:00. The “locomotive” of the euro-zone economy, Germany, saw a drop of 1% in orders back in November. A bounce is on the cards for December: 0.3%.

- German Industrial Production: Thursday, 7:00. Similar to factory orders, industrial output is expected to bounce by 0.8% after a slump of 1.9% beforehand.

- ECB Economic Bulletin: Thursday, 9:00. The European Central Bank publishes the data it had in front of its eyes during the recent meeting. It will be interesting to see the balance of risks, which is moving to the downside according to President Mario Draghi.

- EU Economic Forecasts: Thursday, 10:00. The European Commission publishes its updated economic forecasts three times a year. The upcoming publication comes as darker clouds gather over the old continent. A downgrade of forecasts is definitely on the cards. Germany recently slashed its forecasts for 2019. France has been hit with protests and Italy is officially in a recession.

- German Trade Balance: Friday, 7:00. German exports are behind a euro-zone trade surplus and keep the euro bid. However, demand for exports has dropped, especially from China. A small slide in the surplus is expected: 18.1 billion in December against 19 billion in November.

- French Industrial Production: Friday, 7:45. The second-largest economy suffered a slump in output in November: 1.3%. A bounce is a forecast now: 0.8% is on the cards.

- French Private Payrolls: Friday, 7:45. France saw a small increase of 0.1% in private payrolls in Q3, according to the final print. The same figure is on the cards in the first release for Q4.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar broke above 1.15 (mentioned last week), but could not hold onto its gains and fell back into range.

Technical lines from top to bottom:

1.1620 was a peak in the autumn and is the next line if the pair breaks above 1.1570, which was a swing high in the wake of 2019.

1.1515 was a high point at the end of January. 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier. 1.1345 was a swing low in mid-January.

1.1290 was a low point around the same period of time. 1.1270 was a double-bottom in December 2018 and the 2018 low of 1.1215 is next.

I am bearish on EUR/USD

The euro-zone economies are slowing down faster than the US economy. The ECB will have to change its policy sooner than later. Survey data and other forecasts will likely add to the gloomy picture.

Our latest podcast is titled: Are markets too optimistic on the Fed, China, and Brexit?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!