- EUR/USD maintains its bearish tone amid higher US yields and poor risk sentiment.

- ECB’s Lagarde will speak today while traders are keenly waiting for the NFP data release as well.

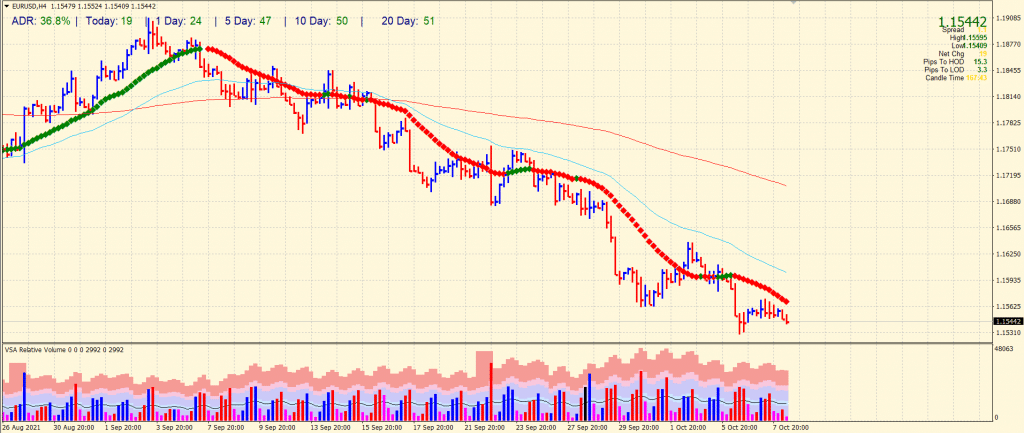

- Technically, the pair remains rangebound between 1.1500 to 1.1600.

As of the start of the European session on Friday, the EUR/USD outlook is accepting bids to retest its intraday low below 1.1550, reversing a recovery movement.

-Are you looking for forex robots? Check our detailed guide-

A mixed mood and cautious sentiment prevailed yesterday as the major currency pair struggled to find a clear direction. The speech of Christine Lagarde, the president of the European Central Bank (ECB), is also crucial.

Higher Treasury yields and market concerns ahead of this week’s US jobs data confirm reports of sellers in the EUR/USD pair, as more favorable sentiment is causing concern for the EUR/USD bears.

The market’s sentiment has improved as Congress extends the $408 billion debt limit through mid-December 2021. Similarly, the Sino-US relationship and the PBOC’s willingness to conserve financial resources and keep liquid markets topped headlines.

A week after returning from vacation, China’s property sector has been cited as a potential risk to financial markets. After Evergrande, Fantasia is another company with prohibitive bonds in the real estate market.

Furthermore, with increased concerns about the Fed slowdown following today’s release of US nonfarm payrolls (NFP), optimists are being challenged. According to forecasts, NFP can increase by 488k against 235k earlier, while unemployment will drop to 5.1% from 5.2% according to previous data.

The ECB minutes and numerous policymakers from the bloc’s central bank dismissed fears of reflation and fears of monetary policy tightening on Thursday. The EUR/USD exchange rate likewise did not rise.

In contrast, the US Dollar Index (DXY) is pushing bids up, tracking the yield on 10-year US Treasuries, which climbed 1.8 basis points to 1.59% at press time. Also, on Thursday, Wall Street had another positive session, with S&P 500 futures following by the evening.

ECB President Christine Lagarde’s speech may entertain traders if she manages to impress with hawkish details, even if the NFP trade lull hampers intraday EUR/USD price movements ahead of key data releases.

-Are you looking for the best CFD broker? Check our detailed guide-

EUR/USD technical outlook: Rangebound between 1.15 – 1.16

The EUR/USD price remains depressed under 1.1550, pointing at further losses towards the 1.1500 mark. The price is well below the key SMAs as well. The average daily range so far is 36%, indicating a silence mode. The upside remains capped by the 1.1600 mark while the support lies at 1.1500. On breaking below the 1.1500 area, the price head towards 1.1470 ahead of 1.1430.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.