- The dollar is pushing higher ahead of the Fed meeting.

- Eurozone inflation rose to 10.7% in October, beating the 10.2% forecast.

- Markets expect the ECB to raise rates by 75bps in light of the skyrocketing inflation.

Today’s EUR/USD price analysis is bearish as the dollar recovers ahead of the Fed meeting. However, this might change as markets also expect a more hawkish ECB.

-Are you looking for automated trading? Check our detailed guide-

Data released Monday indicated that Eurozone inflation increased more than anticipated in October, fueling speculation that the European Central Bank may continue raising interest rates significantly despite sluggish economic growth.

According to Eurostat data, inflation in the 19 nations that use the euro increased to 10.7% in October from 9.9% a month earlier, surpassing the 10.2% estimate in a survey by Reuters and much beyond the ECB’s 2% inflation objective.

In addition, according to Eurostat, the euro zone’s gross domestic product increased by 0.2% from quarter to quarter and 2.1% from year to year. Some economists believe that the central bank could continue to take effective measures to combat inflation due to the economy’s ongoing growth.

“Today’s data increase the likelihood that the ECB will raise its key interest rates again by 75 basis points in December,” Commerzbank said in a research note to clients.

The expansion is critical because many economists believe the ECB would not want to continue hiking rates amid an anticipated recession in the Eurozone.

EUR/USD key events today

The United States will release two important reports that might cause some volatility. These are the ISM manufacturing PMI report and the JOLTs job openings report.

EUR/USD technical price analysis: Bearish reversal not confirmed yet

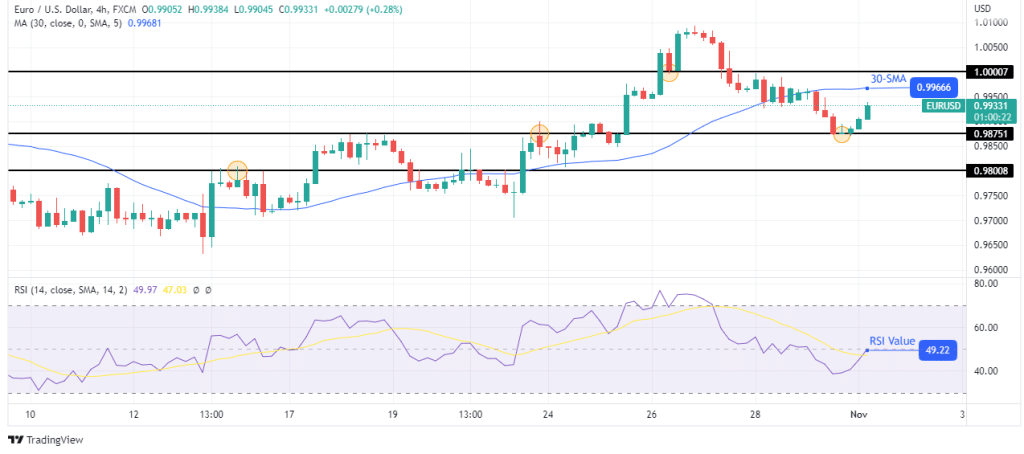

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50. The price is not only back below the SMA but is also trading below parity, showing bears are in control. The 0.9875 support level has stopped bears, and the price looks set to retest the recently broken SMA.

-If you are interested in forex day trading then have a read of our guide to getting started-

The price must start making lower highs and lower lows to confirm a bearish reversal. If this does not happen, the price will likely consolidate close to parity. A bearish reversal would mean taking out the 0.9875 support and heading for the next support level at 0.9800.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.