- The EUR/USD pair dropped, but the bias remains bullish if it stays above the uptrend line.

- A valid breakdown through the uptrend line could activate a larger drop.

- Later, the FOMC Meeting Minutes could bring sharp movements.

The EUR/USD price plunged after reaching the 1.0748 level as the DXY’s bounce back boosted the USD. After its strong leg higher, the currency pair was somehow expected to retreat.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Technically, the current drop could be only a temporary one. The Dollar Index remains under pressure despite the current growth. Despite poor US data reported yesterday, the USD has managed to recover after its massive drop.

As you already know, the Flash Manufacturing PMI, Flash Services PMI, New Home Sales, and the Richmond Manufacturing Index indicators came in worse than expected. On the other hand, the Euro-zone data mixed in the last trading session.

Today, the German Final GDP rose by 0.2%, matching expectations, while the German Gfk Consumer Climate came in at -26.0 points versus -25.6 expected. Later, the US data could bring more action.

Durable Goods Orders are expected to report a 0.6% growth, while the Core Durable Goods Orders could register a 0.5% growth. Fundamentally, the FOMC Meeting Minutes represent a high-impact event. Anything could happen around this report.

EUR/USD price technical analysis: Sellers to pounce

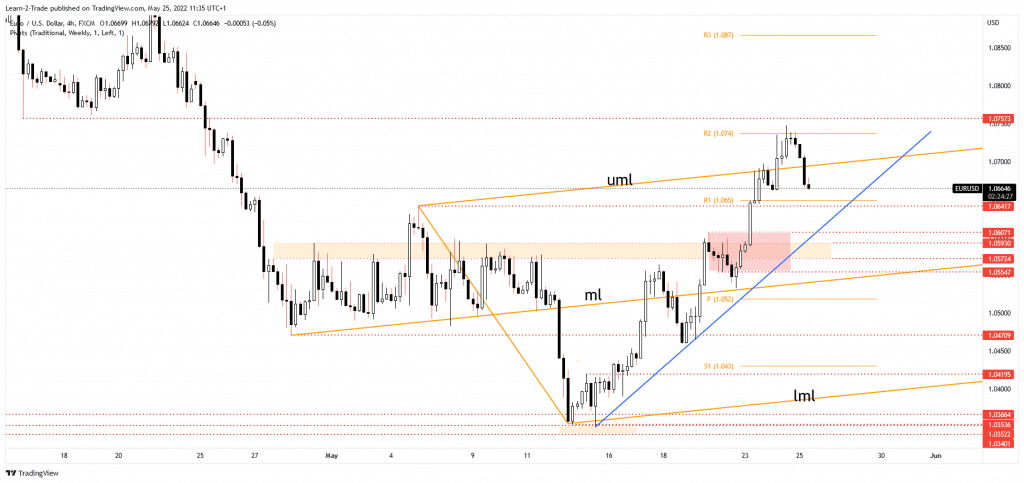

The EUR/USD pair found resistance at the weekly R2 (1.0740), and now it has dropped below the ascending pitchfork’s upper median line (UML), representing dynamic support. 1.0757 was seen as a static resistance, like an upside obstacle, but the rate failed to reach it.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The EUR/USD pair could slip lower if the Dollar Index extends its rebound. The weekly R1 (1.0650) and the 1.0641 are near-term downside obstacles. A deeper drop could be confirmed by a valid breakdown below these levels. The bias remains bullish as long as it stays above the uptrend line in the short term.

A valid breakdown through the uptrend line could signal that the swing higher is over and that the sellers could take full control. Above the R1 and above the uptrend line may signal new bullish momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money