- The EUR/USD pair is under pressure for a second straight day, moving away from its recent daily low.

- US dollar strength is supported by risk aversion and higher yields ahead of a long day.

- The Markit EU/US March PMIs are released in February ahead of US durable goods orders.

- As new Russian sanctions and Moscow-Beijing ties emerge, Biden’s trip to Brussels will be a key NATO event.

Early on Thursday, the EUR/USD price hit an intraday low near 1.0980, continuing the previous day’s losses amid negative sentiment. As a result of higher US Treasury yields and risk aversion, the major currency pair has been weaker recently.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Soaring yields and hawkish Fed

On Wednesday, the US 10-year Treasury yield fell by less than 1.5 basis points (bps) after retreating from a three-year high. The US Treasury yields are rising, favoring bulls in the US Dollar Index (DXY), which is likely to hit the 99.00 level in the near term.

The Fed’s hawkish stance contributed to the recent bond crash by pushing yields higher and favoring dollar buyers. St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester recently endorsed the idea of a Fed rate hike and quantitative tightening (QT) in May.

Russia-Ukraine conflict

Meanwhile, the UK and US are willing to send more aid to Ukraine, even though Russia has edited a list of diplomats flagged as “persona non grata” at the US embassy, affecting market sentiment and driving up US dollar prices. In recent days, US Senator John Cornyn announced he met with Treasury Secretary Janet Yellen to talk about sanctions on Russian gold, signaling the presence of risk aversion before President Biden meets NATO allies in Europe.

The Russian president is willing to insist on ruble payments for oil to “unfriendly” nations and worries that a possible coronavirus outbreak in China and Europe will also challenge sentiment.

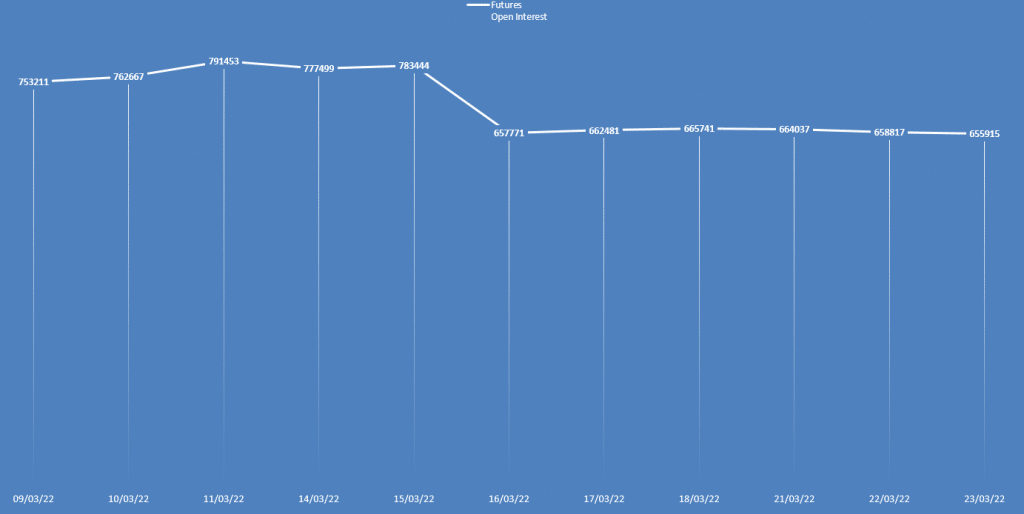

EUR/USD price analysis via daily open interest

The EUR/USD price closed in the red yesterday, while the daily open interest showed no significant change. Hence, there is no clear trend as per open interest.

What’s next for EUR/USD price analysis?

EUR/USD price will probably continue to be pressured by the wave of risk aversion, but the yield movement will determine the direction of EUR/USD rates. Markit’s manufacturing PMI is expected to drop to 56.3 from 57.3 in earlier reports, while the services PMI was expected to drop to 56.0 from 56.5 in March. US durable goods orders are also expected to decline in February, with a previous forecast of -0.5% versus 1.6%.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

EUR/USD price technical analysis: Bears to break the double bottom

The EUR/USD price formed a double bottom at 1.0965 area. The pair is slowly moving towards the level, and if it manages to break the double bottom, we will see a sharp sell-off towards the 1.0900 area, which is another key support area ahead of 1.0805 (multi-month low).

The volume data shows a bearish bias as the down bars have a constantly increasing volume. Moreover, we can see a no-supply bar around 20-period SMA, another sign of rejection.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money