- The EUR/USD pair drops like a rock after taking out the immediate support levels.

- The fundamentals could drive the price at the end of the week.

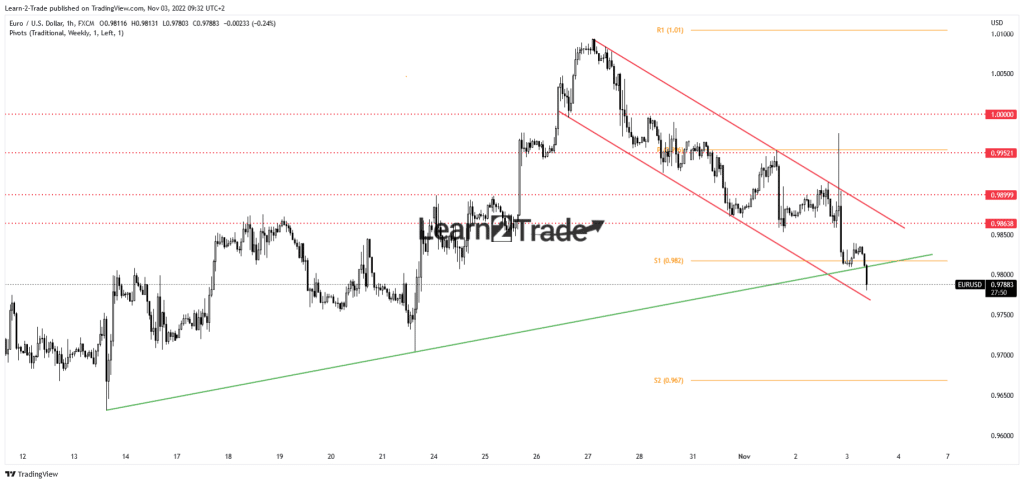

- A valid breakdown below the downside line activates more declines.

The EUR/USD price is trading in the red at 0.9787. The downside pressure is high as the US dollar looks poised to resume its rally after the FOMC Press Conference.

-Are you looking for automated trading? Check our detailed guide-

As expected, the currency pair registered sharp movements in both directions after the FOMC. You knew from my analyses that the fundamentals should drive the markets during the week.

The FED increased the Federal Funds Rate by 75 bps, as expected. Further hikes are expected in the next monetary policy meetings. Higher inflation reported by the US could force the Federal Reserve to raise the rate by 75 bps again.

The greenback rallied, and it seemed determined to dominate the currency market. The USD received a helping hand from the ADP Non-Farm Employment Change. The indicator was reported at 239K versus the 178K expected.

Today, the US ISM Services PMI is expected to drop from 56.7 points to 55.5 points, while Unemployment Claims could jump from 217K to 220K in the last week. In addition, Factory Orders report a 0.4% growth while Trade Balance can be reported at -72.4B.

Tomorrow, the US data could be decisive. The NFP is expected at 205K in October. The unemployment rate could increase from 2.5% to 2.6%, while Average Hourly Earnings may register a 0.3% growth.

EUR/USD price technical analysis: Bearish dominance

From the technical point of view, the EUR/USD pair accelerated its downside movement after registering only a false breakout with great separation through the descending trendline and above 0.9899. It has ignored the upper trendline and the S1 (0.9820), signaling more declines. The channel’s downside line represents the next downside target.

-If you are interested in forex day trading then have a read of our guide to getting started-

As long as it stays below 0.9800 and under the broken upper trendline, the EUR/USD pair could reach fresh new lows. Breaking below the channel’s support may activate a downside continuation. Still, after its massive drop, we cannot exclude minor rebounds, which could bring new short opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.