- The EUR/USD pair recovered well from its lows near 1.1300 during the Asian session.

- US bond yields fell, putting dollar bulls on the defensive and giving the pair a tailwind.

- Fed rate hikes and risk appetite should support the US dollar and limit gains.

After declining to nearly two-week lows in the Asian session, the EUR/USD price rose to a new daily high near 1.1335 in the last hour.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

On Friday’s dip around the 1.1300 level, the pair attracted some buying and has now recovered most of the overnight losses, although a broader uptrend still seems elusive. Furthermore, the sharp decline in US Treasury yields weakened the US dollar, which boosted EUR/USD.

The prospect of a Fed tightening, coupled with the risk-averse environment, should support the safe-haven dollar and the EUR/USD capitalization. Money markets have fully priced in a Fed rate hike in March and four in total in 2022 amid fears of persistently high inflation.

Meanwhile, investors’ appetite for riskier assets was dampened by concerns that rising borrowing costs could hurt corporate earnings prospects. Moreover, dissenting views on Fed and ECB policy should limit any runaway EUR/USD rally, at least for now, as reflected in the recent pullback in equity markets.

Before the upcoming Federal Reserve monetary policy meeting on January 25-26, investors can avoid aggressive bets by waiting on the sidelines. Consequently, clearer signals are expected about the likely onset of the Fed’s tightening cycle, which will give the dollar and the EUR/USD pair a boost.

Before confirming the recent corrective pullback completed from the 1.1480 area, EUR/USD fundamentals suggest caution. Therefore, ECB President Christine Lagarde’s speech will be scrutinized for potential trading opportunities in the near term without a major economic report.

–Are you interested to learn more about forex brokers? Check our detailed guide-

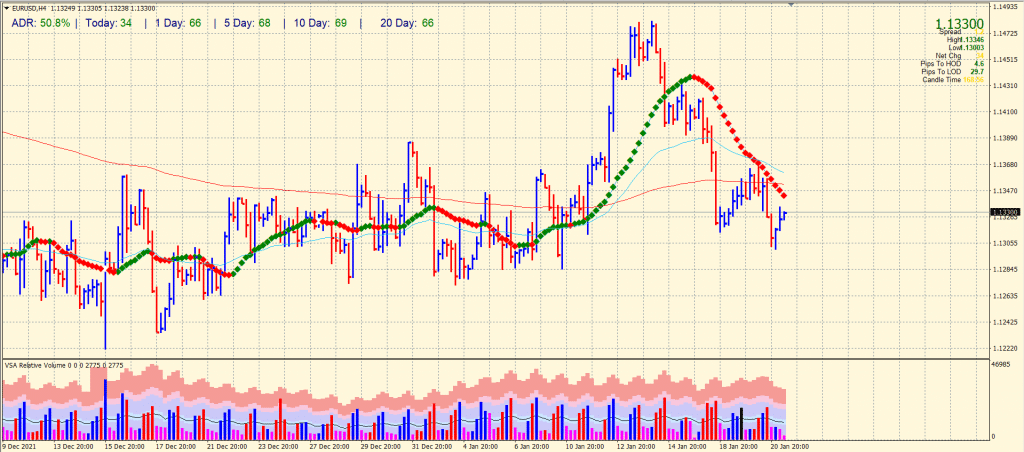

EUR/USD price technical analysis: Bears eying breakout

The EUR/USD price remains below the 20-period SMA on the 4-hour chart despite a minor recovery from the 1.1300 level. The average daily range for the pair is 50% at the moment, which shows potential volatility for the day. If the price breaks below 1.1300, we may see a deeper retracement towards 1.1200. On the flip side, staying above 1.1300 may attract buying towards 1.1400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.