- EUR/USD attempts to retrace a little on Friday.

- Corona cases in the US are weighing on the US Dollar.

- US senators are looking for another stimulus package.

The EUR/USD price, ahead of the European session on Friday, is around the daily low of 1.1875 or -0.05% on the day. The major currency pair reached the previous day’s 4-day uptrend as the pair tested the monthly peak of July 6. However, the risky atmosphere helped protect the USD and support the DXY at its lowest level.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

US President Joe Biden recently urged White House staff to conduct vaccination tests or take routine combat tests because the United States has had the largest infection of the day since February. In Japan, conditions are dire, with the government planning to occupy several prefectures in an emergency and register more than 10,000 cases daily for the first time. It should be noted that recently the levels of coronavirus in Australia and the UK are somewhat moderate, but there are no problems with Delta Covid strains.

Aside from the security risk, fears will also benefit the US Dollar Index (DXY) as the Fed chose measures to lower inflation in June. PCE is the main price index, corresponding to the previous year at 3.7 percent. US inflationary expectations recently peaked in early June and continue to pressure the US Federal Reserve to change its growing monetary policy.

The US senators are looking for a new presidential stimulus, which will challenge the bears in the market. According to Reuters, the US Senate on Thursday prepared for the possibility of a $1 billion bilateral infrastructure bill that President Joe Biden will support over the weekend if lawmakers agree to act.

In addition, a slight slowdown in GDP growth and real estate data, not to mention the recent demand for unemployment in the US, remains a burden on the US Dollar.

On the other hand, Luis de Guindos, vice president of the European Central Bank (ECB) and the balance sheets of the ECB’s strategic meetings, kept inflation fairly high but remained cautiously optimistic about growth. Disappointment with preliminary GDP estimates for Germany and the Eurozone will likely exacerbate weakness against the EUR/USD in the second quarter. But to get new momentum, it becomes increasingly important to keep an eye on US data and risk catalysts.

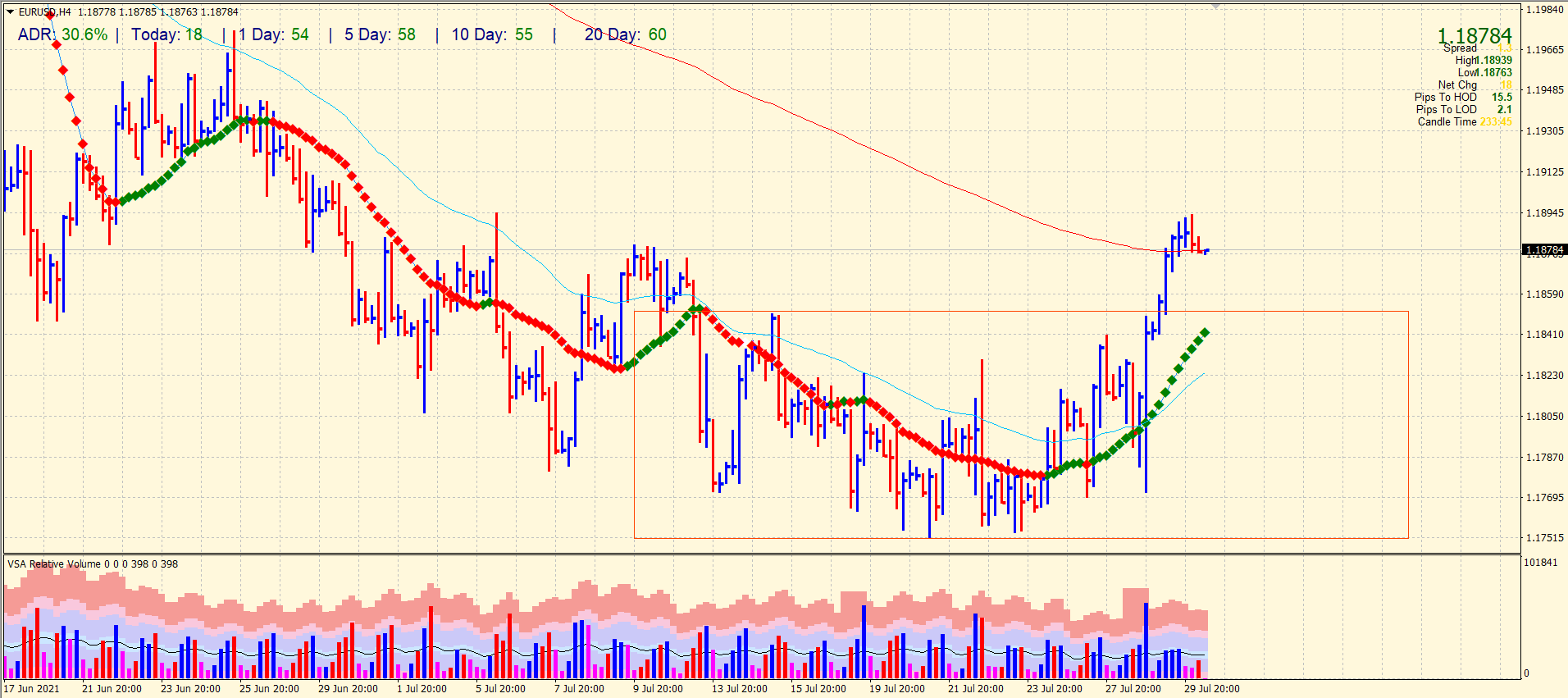

EUR/USD price technical analysis: Where will bulls meet again?

The 4-hour chart shows a breakout of the sideways channel and the congestion of 20 and 50 periods SMAs. However, the price is still shy of the 1.1900 mark and is returning below the 200-period SMA. After the FOMC, the volume went too high and then the volume is too low, mostly below the average. As a result, we can see a mild bearish retracement towards the 1.1850 area, where buyers may find some momentum again.

–Are you interested to learn more about forex robots? Check our detailed guide-

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.