- EUR/USD posted fresh 5-year lows last week.

- Fed’s rate hike speculation keeps Euro under pressure.

- ECB’s offensive stance remains far off from the Fed’s hawkishness.

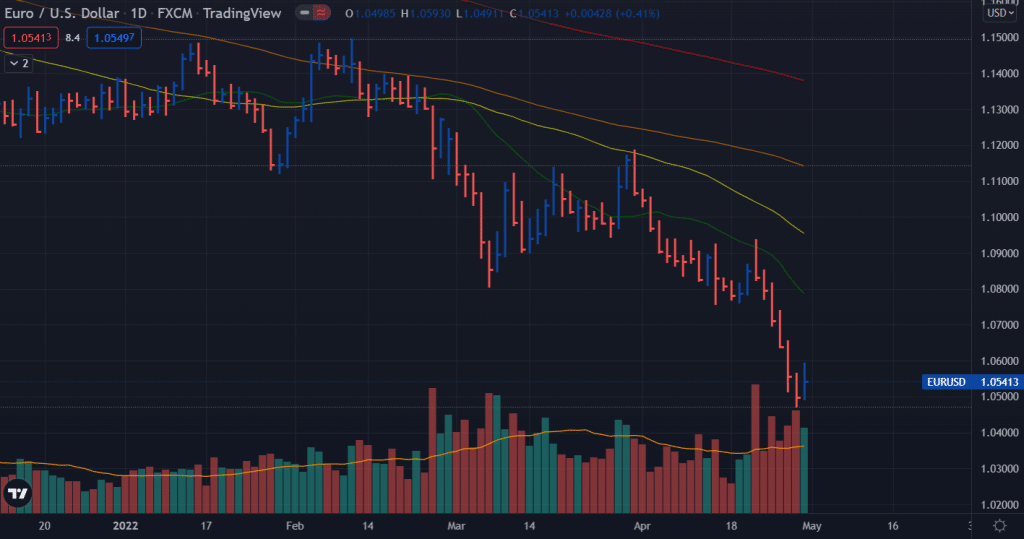

The EUR/USD price recovered somewhat but the weekly forecast remains strongly negative. On Thursday, the EUR/USD dropped to a fresh 5-year low of 1.0470. Apart from the same market fears associated with economic growth that keep investors safe, there was nothing new to threaten further declines in the pair.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Gazprom, the Russian gas supplier, has suspended exports to Bulgaria and Poland for non-payment in rubles. German and Greek officials have said they could provide additional gas to both countries. Still, EU officials generally see this as an attempt by Moscow to blackmail both countries, which will escalate tensions between the two countries. As energy prices rise, central banks are forced to adopt more aggressive monetary policies.

Where ECB Stands when Fed’s Hawkish

Central banks, meanwhile, are currently in a period of inactivity ahead of next week’s monetary policy announcement. Nevertheless, market participants are waiting for a rate hike of at least 50 basis points and the release of more details about the balance sheet trim. It would be the biggest increase in more than two decades and would mark the start of a much more aggressive tightening cycle.

It is important to mention that the central bank’s move was anticipated, and much of it has already been priced in. Uncertainties and potential market drivers emerge from the balance sheet and the pace at which the US Federal Reserve plans to begin cutting rates. Investors will be looking for clues as to how big the Fed hike will be in June, as it is expected to be 75 basis points.

Alternatively, the European Central Bank took an offensive stance. The European Council vice president said earlier that a rate hike could follow the end of the asset purchase programme, which means rate hikes are now expected in July. In addition, Pierre Wunsch, a member of the Board of Governors, hinted at an impending rate hike, noting that rates would rise above zero before the year is over. Since June 2014, interest rates have remained below 0%.

The Federal Reserve has already raised its main interest rate to between 0.25 and 0.50 percent, and it is expected to push it up to around 2.75% by the end of the year. By then, the ECB is unlikely to plan to raise rates above 0%, whereas the market expects at most three hikes and then gradual increases. As a result, most market participants predict a movement of 50 basis points this year. The EUR/USD pair is currently under pressure due to the apparent imbalance between the two central banks, which is likely to continue in the coming months.

Signs of recession in data

The macroeconomic data over the past few days has raised some concerns. The US economy grew by just 1.4% in the first quarter of the year, while Germany’s GDP increased by just 0.2% in the same period. Likewise, the EU’s GDP came in below expectations at 0.2% in the first quarter.

Furthermore, the German consumer price index rose to a four-year high of 7.4% in March, while annual inflation in the Union also hit a multi-year high of 7.5%. US consumer prices rose 6.6% y/y in March, while PCE prices were confirmed at 5.2%, under the expected 5.3%. However, the drop in April suggests inflation may have peaked, even though it is still at an all-time high.

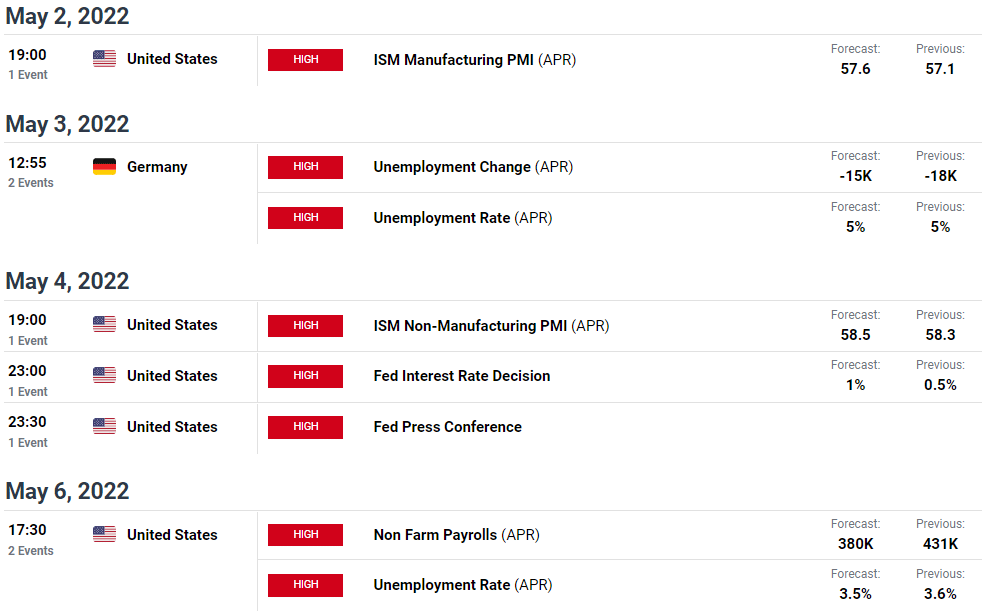

EUR/USD weekly event forecast: Fed, US NFP

There won’t just be one Fed meeting next week. On Friday, the US will release its Nonfarm Payrolls report. The Bank of England will also announce its monetary policy decision. In April, the US is expected to add 400,000 jobs, and the unemployment rate is projected at 3.6%. Employment is one of the two pillars on which the Fed’s decision rests, although it is not currently the main driver.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

EUR/USD weekly technical forecast: No respite for the bulls

Friday’s attempt to recover does not have strong follow-through momentum. The pair may plunge further down towards recently marked lows and even lower towads parity level. The volume was constantly on the rise while the price was falling. Moreover, the daily moving averages are pointing south.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money