- Eurozone inflation went down last month.

- The US unemployment rate hit 3.5% in December, returning to pre-pandemic levels.

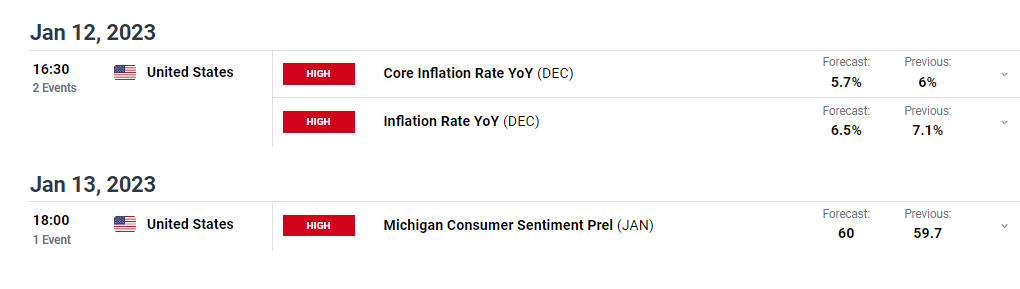

- Investors will watch next week’s release of the US inflation report.

The EUR/USD weekly forecast is slightly bearish as the Fed will likely keep raising rates with a strong labor market.

Ups and downs of EUR/USD

Last week, the EUR/USD was moved by inflation data from the UK and employment data from the US. The European Central Bank will likely continue hiking interest rates for several months even if the euro zone’s inflation dropped last month. This is because underlying price pressures are still rising.

–Are you interested in learning more about forex robots? Check our detailed guide-

The labor market in the US is still tight due to the continuous job growth that helped the unemployment rate return to a pre-pandemic low of 3.5% in December. However, the fact that wage growth has slowed down may provide some solace to Federal Reserve officials, but the US central bank’s fight against inflation is far from over.

Despite the Fed beginning its quickest cycle of interest rate increases since the 1980s in March, the labor market’s tenacity is sustaining the economy by maintaining consumer spending. It raises the likelihood that the Fed will raise its target interest rate above the 5.1% high it had previously predicted and keep it there for some time.

Next week’s key events for EUR/USD

Investors will watch next week’s release of the US inflation report, showing the country’s price increases and the expected course the Fed will take. Investors are expecting a further easing in inflation. A lower value would send the EUR/USD higher, while a higher value would see prices plummet.

EUR/USD weekly technical forecast: A third attempt to break above 1.0701

Looking at the daily chart, we see EUR/USD trading slightly above the 22-SMA and the RSI above 50, indicating bulls are currently in the lead. The bullish trend paused at the 1.0701 resistance level, where bulls could not break above.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

This led to a deep pullback that broke below the 22-SMA. However, the bulls were able to break back above the 22-SMA, showing they were still in control. From here, the price will likely retest the 1.0701 resistance. The break above will lead to a continuation of the bullish trend.

However, if the level holds strong, the price will likely fall to the 1.0403 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money