- EUR/USD gained some momentum during the week as the US dollar corrected lower.

- US yields have gained while the Fed is likely to start tapering asset purchases in November.

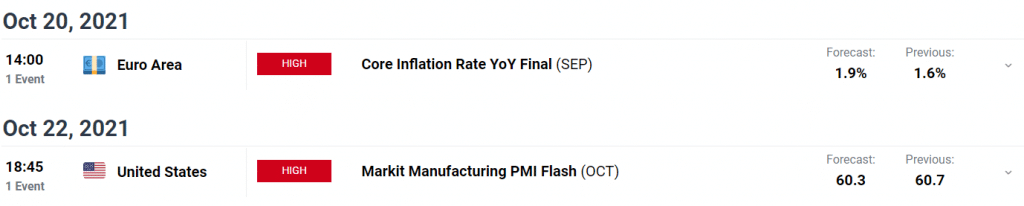

- EU and US PMIs are the key events to watch next week for fresh stimulus.

The EUR/USD weekly forecast suggests a neutral stance as the pair remains stuck around the 1.1600 level. Fed’s hawkishness may weigh on the Euro.

After hitting a new 2021 low of 1.1523, the EUR/USD pair rebounded slightly and closed at 1.1600. After climbing sharply last week, the US dollar fell this week, despite the common currency’s weak performance.

-If you are interested in social trading apps, check our detailed guide-

However, the dollar is still far from the top. While interest rate pressures remain high, the US Federal Reserve is expected to begin reducing its bond-buying program as soon as November this year. US Treasury yields have risen, contributing to these fears, and thus US currency has fluctuated. This allows the dollar to stay strong.

This month’s grim report on non-farm payrolls did not seem to trouble Fed officials. Instead, FRS officials generally indicated a forthcoming drop in employment. According to the minutes from last week’s meeting, it seems likely that asset purchases will start to decline by mid-November and continue until mid-2022. Rate hikes, however, are a much more problematic issue than tapering. The financial stimulus is ending, but Powell and Co. have made it clear that there will be no automatic rate hike.

The US data, on the other hand, was optimistic. The consumer price index in September was 5.4% y/y, a small increase over the preliminary estimate. For the week ending October 8, initial jobless claims dropped to 293,000, while manufacturer-level inflation remained high at 8.6%, much better than expected. Preliminary figures for the Michigan Consumer Sentiment Index were lower in October than expected, dropping from 72.8 to 71.4.

Key data/events for the EUR/USD

Macroeconomic releases will be light this week. Markit will release preliminary estimates of its October PMI for the EU and US next Friday. Before the event, the US will release industrial production, housing data, and weekly jobless claims, while the EU will release September inflation data.

-If you are interested in brokers with Nasdaq, check our detailed guide-

EUR/USD weekly technical forecast: Stuck under 1.1600

After making a double bottom around the 1.1525 area, the EUR/USD price managed to surge towards the 1.1600 level. However, the price remains capped by the 20-day SMA and is reluctant to find acceptance above the 1.1600 level. The price may test the swing low of August 23 at 1.1660 if it overcomes the 20-day SMA. The next resistance can be seen around the 1.1700 level. On the flip side, the double bottom at 1.1525 will likely provide support ahead of the 1.1500 level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.