- US labor statistics for February revealed weaker wage growth.

- Financial markets have reduced expectations for a 50-basis point Fed rate hike.

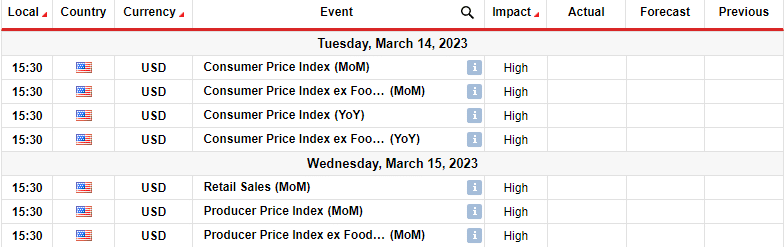

- Investors are awaiting the US inflation report.

The EUR/USD weekly forecast is slightly bullish as bets on big Fed rate hikes have gone down. Overall, the pair closed the week with slight gains.

Ups and downs of EUR/USD

The dollar dropped on Friday as US labor statistics for February revealed weaker wage growth. This indicated that a lessening of inflation pressures may keep the Fed’s pace of rate hikes modest and lessen the dollar’s appeal.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Although the US economy generated jobs quickly in February, financial markets have lowered expectations for a 50-basis point rate hike when Fed officials meet next. This is due to slower pay growth and a rising unemployment rate.

Powell’s hawkish congressional testimony earlier in the week supported the dollar. More support came from job openings and private employment reports. However, investors started seeing cracks in the labor market when the initial jobless claims came in much higher than expected.

Next week’s key events for EUR/USD

All focus next week will be on the US inflation report. Fed Chair Powell warned that policymakers would raise rates higher than anticipated if incoming data proved the economy is still strong after almost a year of tightening. Friday’s mixed US jobs report reduced expectations of big rate hikes.

But, a hotter-than-anticipated consumer price report on Tuesday may rekindle bets on sizable Fed rate hikes.

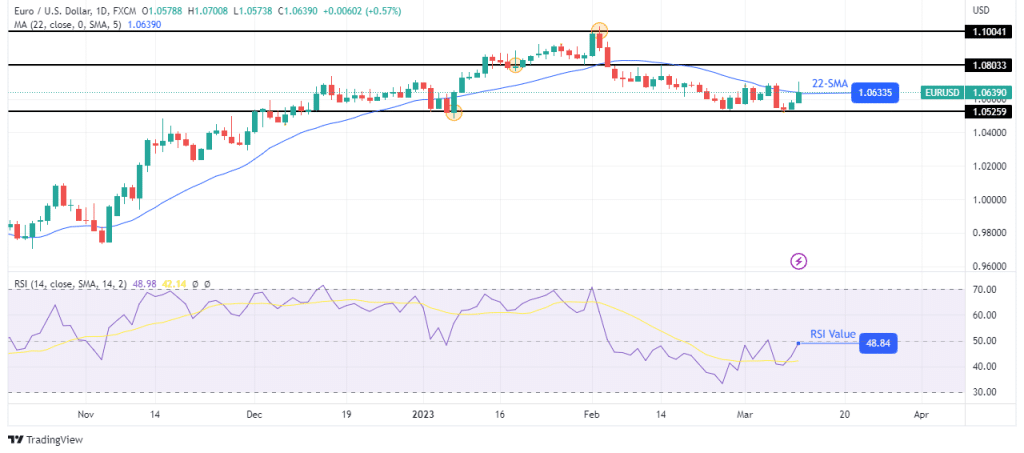

EUR/USD weekly technical forecast: Double bottom could lead to a reversal

The daily chart shows EUR/USD in a weak bearish trend that has paused at the 1.0525 support level. The price has made a double bottom which might lead to a bullish reversal. The bearish trend has been weak, as seen in the small-bodied candles the price has made.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

At the same time, the price has kept close to the 22-SMA, a sign of weakness. The RSI is slightly below the 50-mark, showing bears are still stronger. However, bulls are preparing to break above the 22-SMA and take over control.

If the price goes above the SMA and the RSI above 50, we might see a retest of resistance levels at 1.0803 and 1.1004. The downtrend will continue if the 22-SMA holds firm and the price takes out the 1.0525 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money