EUR/USD is pressured to the downside on shifting global moods. What’s next for the common currency?

The team at SocGen sees nice technical patterns:

Here is their view, courtesy of eFXnews:

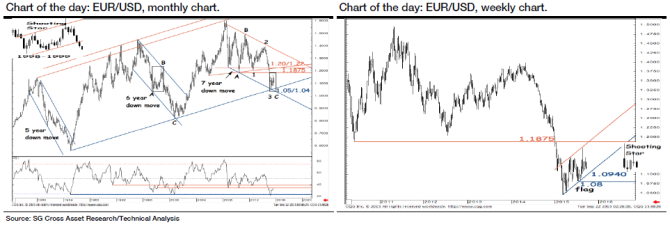

After testing key support at 1.05/1.04 in March, EUR/USD has embarked on a recovery that has been encompassed within an upward channel and appears to be a flag which is normally associated with pullbacks in elongated downtrends, notes SocGen.

“This price action resembles to the one back in late nineties, then too EUR/USD underwent pullback in a similar upward channel and it finally ended with a shooting star like the one formed last month,” SocGen adds.

The shooting star along with monthly indicators which are close to resistance suggest, according to SocGen, that the recovery is likely short-lived and the pair could have been already set to resume its downtrend.

“Flag support at 1.0940 will hint at a retest of 1.08 and even a move towards multi decadal channel at 1.05/1.04 which remains a decisive level for next phase of downtrend,” SocGen argues.

“Short term, EUR/USD has been experiencing unsettled price action as highlighted by sharp up and down swings. Currently it is forming a head and shoulder pattern. Near term rebound, if any, is likely to be confined to 1.1440, more importantly at 1.1565, the 76.4% retracement from last month highs,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.