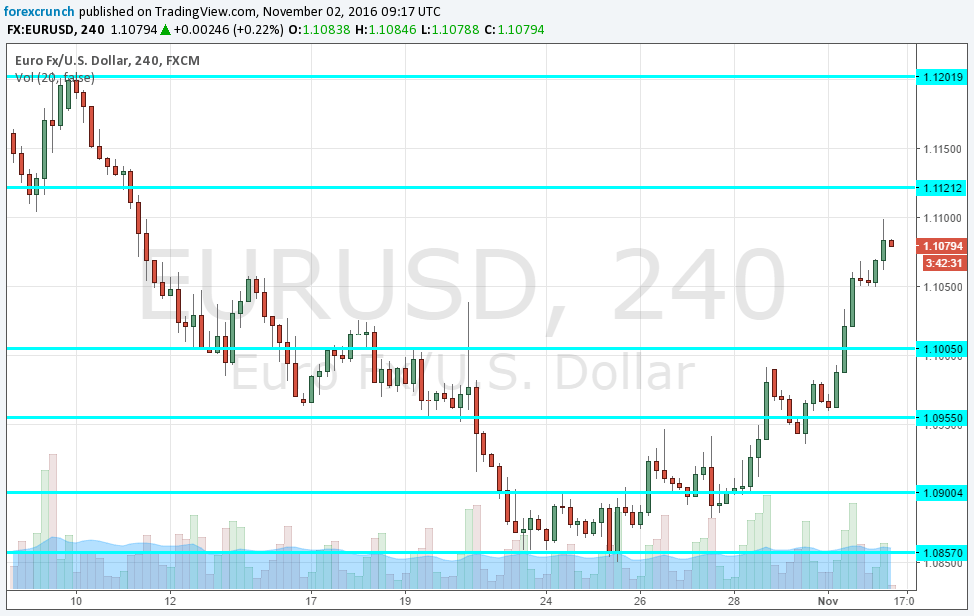

EUR/USD continues gaining ground and has already touched 1.11. The key level to watch is 1.1120, that served as a double bottom when the pair traded at higher ground, before the dollar surge. Further resistance is at the round level of 1.12, followed by 1.1280 and 1.1370. Support awaits at 1.10 and 1.0960.

The reason for the surge of the euro comes from the dollar side: the greenback is losing ground across the board and the euro gains ground. The common currency is not the safe haven it used to be in 2015 and still trails the yen in the haven competition, but the gains are impressive.

Trump troops at the gates

On Friday, the FBI made an announcement about looking into Clinton emails and the dollar suffered. There was some relief on Monday, as there seemed to be no real fire around the smoke. However, the trend resumed on Tuesday, especially as one influential poll put Trump ahead of Clinton.

The overall picture is still positive for Clinton, but the narrowing gap and the trend do not bode well for the mainstream candidate. Stock markets have been trumped by Trump. A new narrative could change that, but there is little time: 6 days to go. Over 28 million Americans have already voted.

More: EUR/USD: Staying Short: 4 Macro Reasons Plus Technicals – Credit Suisse