EUR/USD is now trading under resistance, in the levels it fell to after the Slovak PM said there’s a 50/50 chance of a euro breakup. The focus will shift away from Europe now to Jackson Hole, where Bernanke will deliver a highly awaited speech. Expectations for QE3 hints are now lower, so any talk of new easing could hurt the dollar. If Bernanke says nothing, the pair could lose uptrend support. A stormy end to August is expected before a very busy September enters.

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

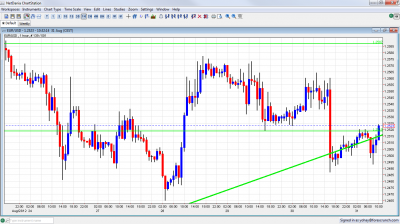

EUR/USD Technical

- Asian session: Euro/dollar edged remained steady under 1.2520.

- Current range: 1.2440 to 1.2520.

Further levels in both directions:

- Below: , 1.2440, 1.24, 1.2360, 1.2330, 1.2250, 1.22, 1.2144, 1.2043, 1.20, 1.1876 and 1.17.

- Above: 1.2520, 1.2587, 1.2623, 1.2670, 1.2743 and 1.2814.

- 1.2520 quickly switched to resistance, that will not hold if Bernanke promises easing. 1.2587 is already much stronger.

- 1.2440 already showed it’s strong, but could fall if Bernanke doesn’t deliver.

- Note that the pair is now struggling with uptrend resistance.

Euro/Dollar under resistance before Big Ben – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Retail Sales. Exp. +0.2%. Actual -0.9%. Big disappointment.

- 8:00 Italian unemployment rate. Exp. 10.9%. Actual 10.7%.

- 9:00 Euro-zone CPI Flash Estimate. Exp. 2.5%.

- 9:00 Euro-zone Unemployment Rate. Exp. 11.3%.

- 13:45 US Chicago PMI. Exp. 53.6 points.

- 13:55 US Consumer Sentiment (revised). Exp. 73.7 points.

- 14:00 Ben Bernanke talks at Jackson Hole. See why Bernanke will likely disappoint.

- 14:00 US Factory Orders. Exp. +1.7%.

- 18:30 IMF managing director Christine Lagarde talks in Jackson Hole.

EUR/USD Sentiment

- Bernanke now carries low expectations: The dovish FOMC meeting minutes raised expectations for new QE hints in Jackson Hole, a repeat of 2010. However, data has improved since then, and expectations are lower. So, this is a two way trade – a disappointment from Bernanke will boost the dollar, while hints that the Fed will hit the printing press will weaken it. There is a higher chance that Bernanke will disappoint and that there will be no QE3 in September. If QE3 is on the table, it will be clear that the Fed aims for a higher nominal GDP, or higher inflation to erase debt.

- Draghi skips Jackson Hole: ECB head Mario Draghi raised expectations in his last minute decision not to attend the Jackson Hole conference, citing a “heavy work schedule”. Also other ECB members cancelled their attendance., Expectations are that Draghi is busy preparing a plan to help lower borrowing costs for struggling Euro-zone members, notably Spain and Italy. The September 6 rate decision is now predicted to provide details to the general bond buying blitz plan introduced in early August. It is interesting to note the head of Germany central bank, Jens Weidmann, did not cancel his flight to Wyoming. There is talk that he could resign over the bond buying scheme.

- Spanish regions need help: After Catalonia asked for 5 billion euros of aid, also its southern neighbor joined in. This adds pressure on the central government to hurry up and ask for aid. Spain holds government meetings on Fridays, and they have a chance to act today. There was further bad news out of Spain as the country saw its economy downgraded for 2010 and 2011. Q2 for 2012 worsened to -0.4%, and the employment situation is abysmal, with an unemployment rate of over 24%. There are reports of ongoing negotiations between Spain and its European peers regarding a formal aid request. Spain is due to repay over 30 billion euros in October, so expect some agreement to be hammered out very shortly.

- Slovak storm: Robert Fico, the old/new PM of Slovakia hurt the vulnerable euro with a surprising statement about a 50/50% chance of a euro breakup. Slovakia, a member of the euro-zone, has taken its time in the past with ratifying one of the deals. In Finland, another core country, the population is actually less euro skeptic than previously thought.

- Bond market expecting action: In the meantime, Spanish and Italian yields are doing OK, in anticipation of the ECB blitz.Thursday’s Italian 10-year Bond Auction saw yields drop to 5.82% from 5.96% in July. Spanish 10-year yields have been fairly steady, in the 6.40% range. This is a far cry from the unsustainable rates above 7% which we saw just last month.

- Greek situation still dire: Greek Prime Minister Antonis Samaras is seeking an extension until 2016 to meet the bailout targets. but German officials have tersely responded that “more time means more money”. Greece’s coalition partners are negotiating a new austerity package, which Samaras promises to be the last one. Talks with the troika will resume in September.

- German politicians have mixed views about the Grexit: It was refreshing to hear some German politicians talking about the geopolitical importance of Greece (a NATO member) and not only look at a Grexit from a pure economical view. However. discussions about a manageable Grexit are getting louder: this time from the ECB’s Jörg Assmussen, that echoed Eurogroup chief Juncker. German grumbling is growing over Greece’s request for an extension, and a senior member of the Christian Social Union, a coalition partner, said he saw Greece leaving the euro next year. Other coalition partners are dead set against providing Greece with more time or money. See how to trade the Grexit with EUR/USD.