Euro dollar is in the same high range, unconvinced from the Greek deal, but not going anywhere fast. Mixed purchasing managers’ indices don’t help the pair pick a direction. As long as the Greek deal doesn’t fall apart (which certainly isn’t certain), the next big event is the ECB’s LTRO. Today the US joins with the important existing home sales figure.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

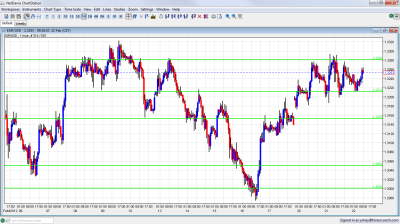

EUR/USD Technicals

- Further levels in both directions: Below: 1.3212, 1.3145, 1.3060, 1.3060, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2620.

- Above: 1.3280, 1.3333, 1.3450, 1.3550 and 1.3650.

- 1.3333 is the line capping the year’s highs. A break above would be a bullish sign.

- 1.3212 is weaker support now. 1.3145 strengthens.

Euro/Dollar in range – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:30 French CPI. Exp. -0.1%. Actual -0.4%.

- 8:00 French Flash Services PMI. Exp. 52.3. Actual 50.3 points.

- 8:00 French Flash Manufacturing PMI. Exp. 49.1. Actual 50.2 points – a return to growth.

- 8:30 German Flash Services PMI. Exp. 53.8 points. Actual 52.6.

- 8:30 German Flash Manufacturing PMI. Exp. 51.6 points. Actual 50.1 – disappointment.

- 9:00 Euro-zone Flash Services PMI. Exp. 50.7 points. Actual 49.4 points. Back to contraction.

- 9:00 Euro-zone Flash Manufacturing PMI. Exp. 49.4 points. Actual 49.

- 10:00 Euro-zone Industrial New Orders. Exp. +0.6%.

- 14:00 Belgian NBB Business Climate. Exp. -8.2 points.

- 15:00 US Existing Home Sales. Exp. 4.66 million. See how to trade this event with USD/JPY.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- Greek PSI in Focus: After the deal was reached, Greece is proceeding with the haircut for private bondholders. Due to the insistence of the IMF, the private sector haircut was raised to a nominal value of 53.5%, voluntarily of course. This means around 73% in real terms. Note that some hedge funds have an interest to trigger the Credit Default Swaps, as they will more money on a default.

- IMF Contribution Only in Second Week of March: The International Monetary Fund, which is massive funding from the US, is expected to provide a much smaller contribution to the second bailout. This means that EU countries will have to contribute more. The decision will take place only in the second week of March.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- ECB LTRO II: The first unlimited 3 year loans managed to stabilize the banking system and to create an incentive for banks to buy Italian and Spanish bonds. The second LTRO is due on February 29th and can attract even 1 trillion euros. The success of this operation can make European leaders feel safe and let go of Greece.

- Portugal awaits Greece: Portuguese yields remain on high ground. The path chosen for Greece will likely be followed by the small Iberian country in the infamous “contagion” effect that is feared.

- More Positive US figures: Yet again, US jobless claims dropped to lower pre-crisis levels. The housing sector is more sensitive. Also the forward looking Philly index exceeded expectations, although its employment component was weaker than last month. The general picture of gradual improvement continue. This week doesn’t feature too many US figures.