Euro dollar remains on high ground and is trading in a narrower range. S&P downgraded Greece to “Selective Default” and hinted that if the bond swap won’t go as planned, an outright default is on the cards. Tension is mounting towards the ECB’s LTRO. Today we have quite a few US figures.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

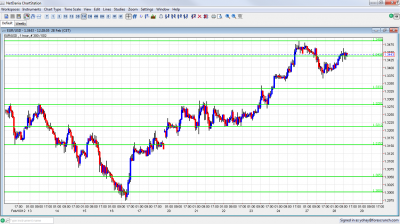

EUR/USD Technicals

- Asian session: Slow session sees the pair eventually slip lower, under 1.3430.

- Current range: 1.3430 to 1.3486.

- Further levels in both directions: Below: 1.3430, 1.3333, 1.3280, 1.3212, 1.3145, 1.3060, 1.3060, 1.2945, 1.2873 and 1.2760.

- Above: 1.3486, 1.3550, 1.3615, 1.37, 1.38 and 1.3950.

- 1.3333 now switched into support, after the convincing break.

- 1.3430 is a minor pivotal line

Euro/Dollar stable on high ground – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Consumer Climate. Exp. 6.1. Actual 6.

- 13:30 US Durable Goods Orders. Exp. -0.8%. Core exp. 0%.

- 14:00 US S&P/CS Composite-20 HPI. Housing is important for QE3.

- 15:00 US CB Consumer Confidence. Exp. 63.1 points.

- 15:00 US Richmond Manufacturing Index. Exp. 11 points.

- 15:00 US FOMC member Elizabeth Duke talks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- S&P Declares Selective Default: While it was widely expected, this is still an important event. The credit rating agency hinted that if the bond swap doesn’t pass, it will be an outright default. The European Central Bank already swapped its Greek bonds to ones that would be immune of the aforementioned CACs. This means that they have priority.

- ECB LTRO II: The first unlimited 3 year loans managed to stabilize the banking system and to create an incentive for banks to buy Italian and Spanish bonds. The second LTRO is due on February 29th and can attract even 1 trillion euros. The success of this operation can make European leaders feel safe and let go of Greece.

- Bond Swap Clock Ticking: Greece approved and officially launched an offer for a bond swap. The big haircut casts doubt that it will find enough volunteers. A big majority is needed, for the non-volunteers to be swapped as well via the Collective Action Clauses. Note that some hedge funds have an interest to trigger the Credit Default Swaps, as they will more money on a default. A special report about Greece is ready for you to download. Just join the newsletter and get the report.

- IMF Contribution Only in Second Week of March: The International Monetary Fund, which is massive funding from the US, is expected to provide a much smaller contribution to the second bailout. This means that EU countries will have to contribute more. The decision will take place only in the second week of March.

- Germany approves Greek bailout: The German parliament approved the Greek bailout. There wasn’t an absolute majority among coalition members. The IMF contribution isn’t known at the moment. This deal may never see the light of day. Note that Europe was told to help itself in the G-20 meeting.

- German court hurdle: A German court might delay the euro-zone aid package by forcing a different procedure in parliament. Given past experience, this hurdle will likely be overcome.

- Germany improving: Despite the contraction in Q4, Germany will likely escape recession. The recent IFO and ZEW figures were better than expected. With an unemployment rate of 5.5%, Germany is attracting immigrants and envy.

- German interior minister advises Greece to leave: Hans-Peter Friedrich told Der Spiegel that he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- US Housing still sensitive: The sensitive housing sector has shown minor improvement via the existing home sales figure . Single family houses are still struggling, as well as foreclosures. The trend of falling jobless claims, at least in the 4 week moving average continued. The Case Schiller index becomes more important due to this sensitivity.