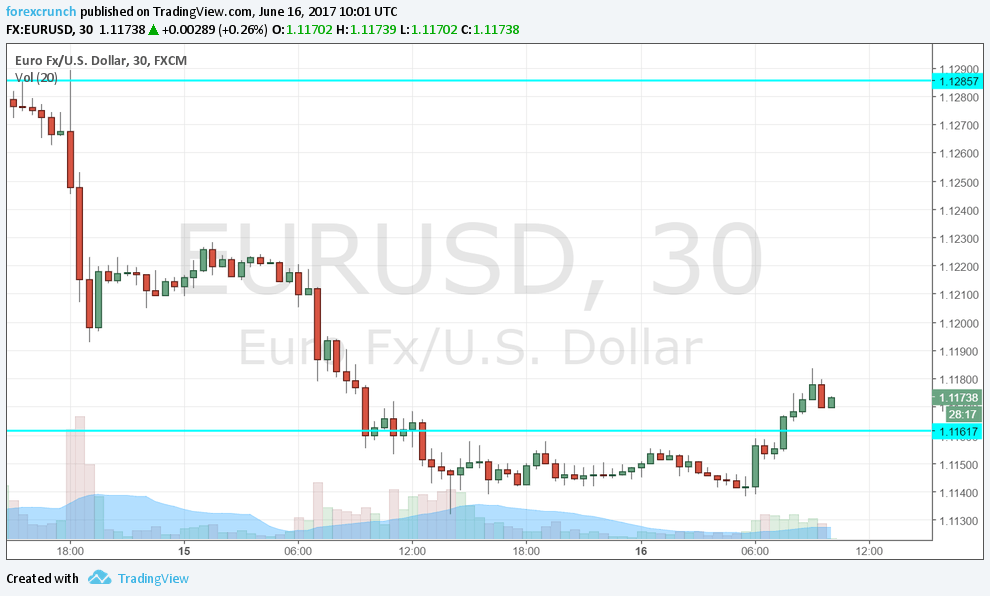

EUR/USD is making a move to the upside, trading around 1.1180. It recovered from the lows of 1.1138. More importantly, the pair is above the 1.1160 level it seemed to have lost.

Earlier this week, EUR/USD reached new 7-month highs by edging closer to 1.13. That was driven by weak US inflation data. However, this latest attempt was stalled at 1.1295 and the pair dropped sharply after the Fed made its hawkish hike.

As the dust settles from the Fed storm, we get some European data. Inflation was confirmed at 1.4% for CPI and 0.9% for Core CPI in the month of May. While this wasn’t a surprise, euro-zone inflation is not deteriorating beyond what was known.

Another positive development comes from Greece. The debt-stricken country will receive 8.5 billion euros from its creditors, with the money basically going to pay back those same creditors. This Greek crisis has been away from the headlines. In any case, nothing of substance is expected until after the German elections.

More: EUR/USD: Staying Tactically Short on perfect USD liquidity storm – Danske

Can EUR/USD continue higher?

The US dollar has been the driver this week, with weak data, an optimistic central bank and also new trouble for the president. Donald Trump is under investigation for obstruction of justice.

The next moves could come from fresh economic figures from the US: building permits, housing starts and perhaps most importantly consumer confidence. In addition, keep an eye open for political developments, although these have had a limited effect of late.