EUR/USD ended the month with a mixed note. The first week of February features PMIs among other indicators. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone inflation came out marginally above expectations, but on the other hand, German business confidence disappointed. Draghi repeated the dovish stance, but this was somewhat forgotten. In the US, the Fed erred to the side of caution, lowering the chances of a hike in March, as data was underwhelming to say the least.

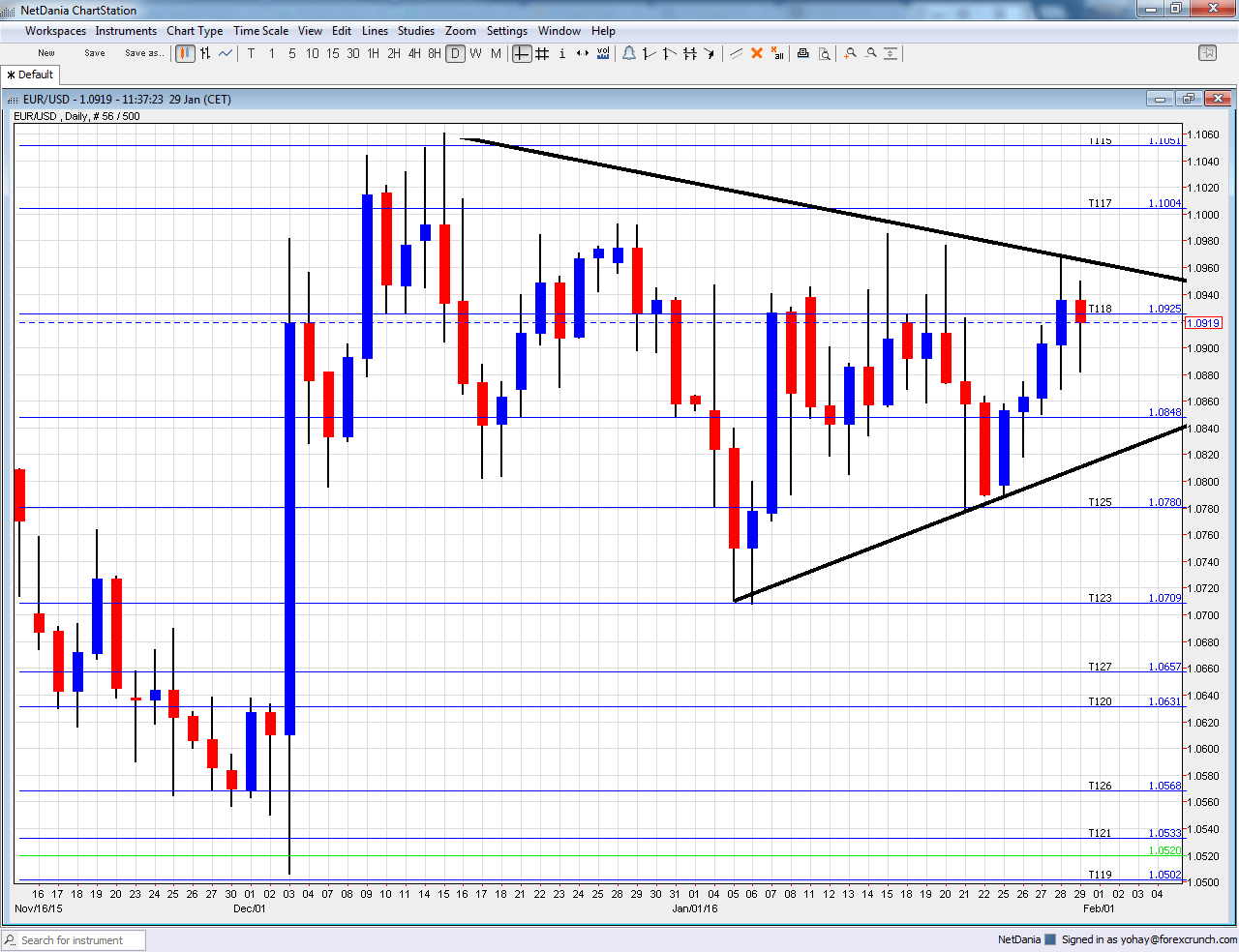

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Mario Draghi talks: Monday, 16:00 and Thursday, 8:00. The president of the ECB knocked down the euro in the recent rate decision but the pair never really went very far. Given the internal struggle within the Frankfurt based institution and the recent inflation data, it will be interesting to hear what he has to say now about the March meeting. He may give a shot of hitting the euro when it’s down. However, just repeating the dovish stance won’t cut it.

- Manufacturing PMIs: Monday: Markit publishes the data for Spain at 8:15, Italy at 8:45, final French data at 8:50, final German figures at 8:55 and the final euro-zone figure at 9:00. The fourth largest economy had OK growth in the manufacturing sector, with 53 points. 52.7 is expected now. Italy, the third largest one, enjoyed stronger growth at 55.6 points and is now expected to see 54.9.. According to the preliminary release, France, the second largest economy, was perfectly balanced between growth and contraction at 50 points. Germany had 52.1 and the whole euro-zone 52.3 points. The preliminary figures are expected to be confirmed now.

- Spanish Unemployment Change: Tuesday, 8:00. This monthly release is watched due to Spain’s perilous job market. In December, 55.8K people came out of unemployment. A rise of 71.2K is on the cards.

- German Unemployment Change: Tuesday, 8:55. The continent’s largest economy enjoys persistent drops in the number of unemployed, standing at 14K in November. We will now get the full year data. Another drop of 8K is expected.

- Unemployment Rate: Tuesday, 10:00. The unemployment rate is falling in the euro-zone but still remains high. In November, it surprised with a drop to 10.5%. The same level is expected now.

- PPI: Tuesday, 10:00. Producer prices feed into consumer prices and impact the ECB’s decisions. A drop of 0.2% was seen in November. -0.4% is predicted now.

- Services PMI: Wednesday: Markit publishes the data for Spain at 8:15, Italy at 8:45, final French data at 8:50, final German figures at 8:55 and the final euro-zone figure at 9:00. Spain and Italy both enjoyed nice growth in the services sectors, 55.1 and 55.3 respectively, back in December. Drops to 54.6 and 54.2 are expected now. According to the initial figures for January, France remained behind with weak growth of 50.6, Germany saw 55.4 and the whole euro-zone stood on 53.6. Markit is expected to confirm these reads now.

- EU Economic Forecasts:Wednesday, 10:00. Every 6 months, the European Commission publishes economic forecasts, including not only growth but also other numbers. Will they downgrade the data because of China?

- Retail Sales: Wednesday, 10:00. While this indicator is published after German and French figures, it still moves markets. In November, the volume of sales dropped by 0.3%. In December, a rise of 0.4% is expected.

- ECB Economic Bulletin:Thursday, 9:00. In the recent rate decision, Draghi told us about further downside risks. We ill now learn a bit more about the ECB’s work and estimations about the economy that were sitting in front of the members’ eyes.

- Retail PMI: Thursday, 9:10. This purchasing managers’ index for the retail sector has suffered a slide to contraction territory, with a fall below 50 points back in November. Also December saw a poor score of 49 points.

- German Factory Orders: Friday, 7:00. The volume of orders rose in both October and November, beating expectations on both occasions. Will the positive trend continue? A slide could be seen now, of -0.4%.

- French Trade Balance: Friday, 7:45. Contrary to Germany, France has a trade deficit, which stood on 4.6 billion in November. Another negative number is on the cards now: -4.5 billion.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week on lower ground, holding above 1.0780 (mentioned last week). It then made an upwards move but always seemed limited and eventually turned south.

Technical lines from top to bottom:

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1050 is the high seen in December and the next challenge on the upside.

1.10 is a round number and significant resistance. 1.0925, which was a support line in December, is the next support line. 1.0850 was the level the pair bounce off at the dying moments of 2015.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015. 1.0630 worked as nice support in November 2015 and then switched to resistance.

It is the last line before plunging to 1.0530, that supported the pair in April. Below, the 12 year low of 1.0460 seen in March.

Wedge

As the black lines show, EUR/USD is trading in a narrowing range, formed by the recent tightness. Will it break up or down? It is currently in the middle.

I am neutral on EUR/USD

The euro is supported by safe haven flows: worries about the global economy, oil, the Chinese economy and also the US economy. The same weakness of the US economy pushes back the next US rate hike, which is seemingly positive as well for EUR/USD, but due to the positive nature of not raising rates, the safe haven flows are watered down. The mixed picture continues with the ECB: we don’t know if Draghi will have the upper hand on more easing. All in all, we could see another week of choppiness.

In our latest podcast we update from the currency war front