EUR/USD was under some pressure on the ongoing crisis in Catalonia. The upcoming week is dominated by the all-important ECB decision. What will be the new size of the QE program? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Catalan crisis continued weighing on the euro, with the imprisonment of two high-ranking independence leaders. Things later deteriorated with Puigdemont’s threats and Rajoy’s tough response. Spain’s GDP forecasts are being revised to the downside and the fourth-largest economy in the euro-zone could become a more significant source of worry. Germany’s ZEW figure slightly missed expectations while final inflation figures provided no surprises. Everything is ready for Draghi, with mounting speculation.

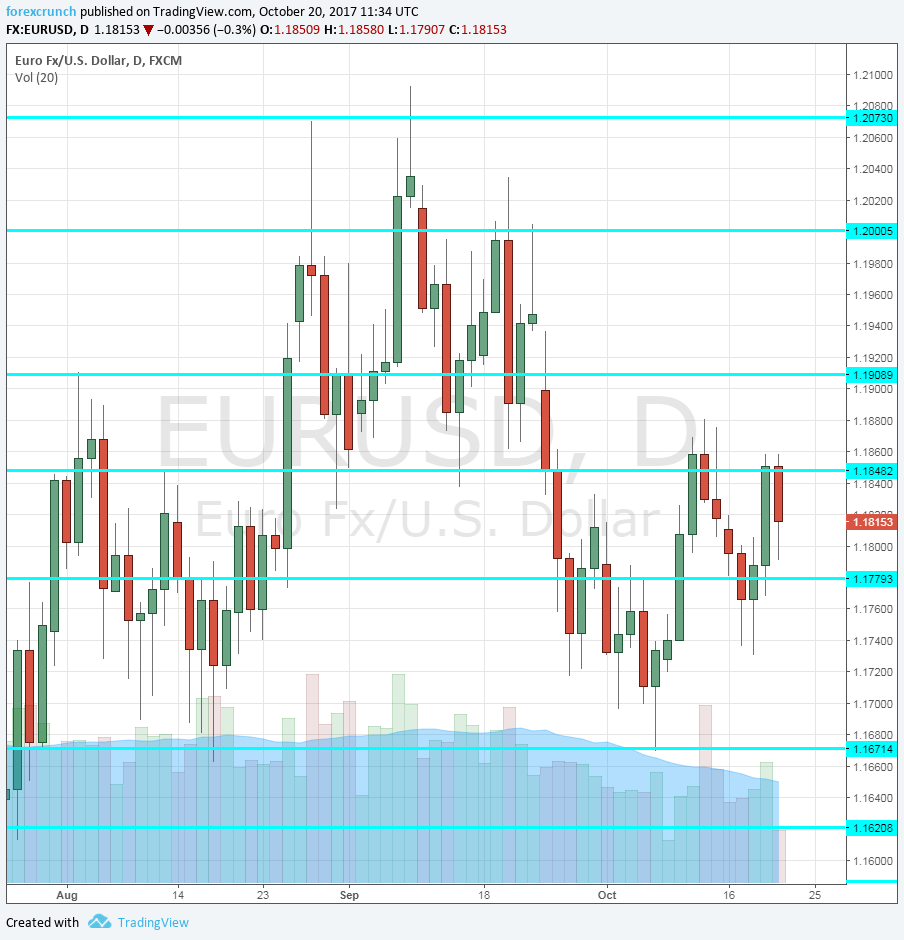

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Buba Monthly Report: Monday, 10:00. The German central bank, the Bundesbank, publishes a monthly report about the economy. Is growth still strong? Are there signs of inflation? These topics will be in the limelight.

- Consumer Confidence: Monday, 14:00. The official measure of inflation by Eurostat got very close to reaching a balanced level of 0 but remains in negative numbers. At -1 seen in September, consumer confidence appears to be mildly pessimistic. A similar level is on the cards now.

- Flash PMIs: Tuesday morning: 7:00 for France, 7:30 for Germany and 8:00 for the whole euro-zone. Markit’s manufacturing purchasing managers’ indicator for France stood at 56.1 points, well above the 50 point threshold that separates expansion from contraction. The services PMI stood at 57 points. Germany’s manufacturing PMI hit a very high level of 60.6 points. The services PMI lagged with 55.6 points. For the whole euro-zone, the scores were 58.1 and 55.8 for manufacturing and services respectively.

- German Ifo Business Climate: Wednesday, 8:00. IFO is Germany’s No. 1 Think-tank. After long months of beating expectations, the business climate slipped to 115.2 points in September below expectations. The parallel ZEW figure already disappointed for October. Will IFO follow? A score of 115.3 is predicted.

- Belgian NBB Business Climate: Friday, 13:00. The 6000-strong survey shows slightly worsening conditions: -3.5 points in September. It had already topped 0 in January but fell under this level afterward. A score of -2.9 is expected.

- German GfK Consumer Climate: Thursday, 6:00. Similar to businesses, also consumers were slightly less optimistic in September, with the GfK measure slipping from 10.9 to 10.8 points. A repeat of the same number is on the cards.

- Spanish Unemployment Rate: Thursday, 7:00. The fourth-largest economy suffered from the crisis in Catalonia, but this will not appear in the quarterly unemployment rate for Q3. In Q2, it stood at a whopping level of 17.2%, yet this is much lower than the peak of above 27% seen in the worst years. A level of 16.7% is predicted.

- Monetary data: Thursday, 8:00. Just before the all-important ECB meeting, we will get the change in the money in circulation (M3 Money Supply), which stood at 5% y/y, a very healthy pace, back in August. Private loans increased at an annual rate of 2.7%. Similar numbers are on the cards.

- Rate decision: Thursday, the decision is at 11:45, press conference at 12:30. The ECB is not expected to change its interest rates, but an announcement about the future of the QE program is on the cards. The Bank currently buys bonds worth 60€ billion per month. This program expires at the end of the year. Recently, reports have circulated that they intend to cut it to between 25 to 40 billion euros, with this extension running through September 2018. Another report suggested that a balance sheet of 2.5 trillion euros is the limit. This leaves them with limited space for bond buys, as they are expected to hit 2.28 trillion by year-end. Expectations stand at around 30 billion per month for 9 months. A slower pace of reduction will hurt the euro while a higher pace can boost it. A lot also depends on the tone of the ECB President Mario Draghi. Back in September, he complained about the exchange rate quite a bit. Since then, EUR/USD is some 200 pips lower. Will he express satisfaction or continue trying to press the euro lower? This time, no new forecasts are planned, so Draghi’s words carry more weight.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar struggled early in the week, gradually moving away from 1.1830 mentioned last week.

Technical lines from top to bottom:

1.2240 is a high line from 2014. The cycle high of 1.2090 looms above.

1.20 is the obvious round level and also worked as resistance in September. 1.1910 held the pair down back in August.

1.1830 capped the pair in August and in October while working as support in September.

1.1670 was a swing low in October.

It is followed by the round number of 1.15. 1.1445 is the June 2017 peak and immediate resistance.

I am neutral on EUR/USD

The ECB may have created expectations for a significant tapering only to go more slowly. It is important to remember that Draghi wants a weaker euro and may act to achieve his goal by setting expectations. The crisis in Catalonia kept the euro a bit lower within the range, and it could rise now. However, the US has its own issues and EUR/USD is quite a stubborn currency pair, refusing to fall.

Our latest podcast is titled Black gold shining and comparing QEs

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!