The US dollar has been under pressure from other major currencies, mostly due to the dovish minutes.

Moving from fundamentals to technicals, some interesting patterns emerge, according to the team at Nomura:

Here is their view, courtesy of eFXnews:

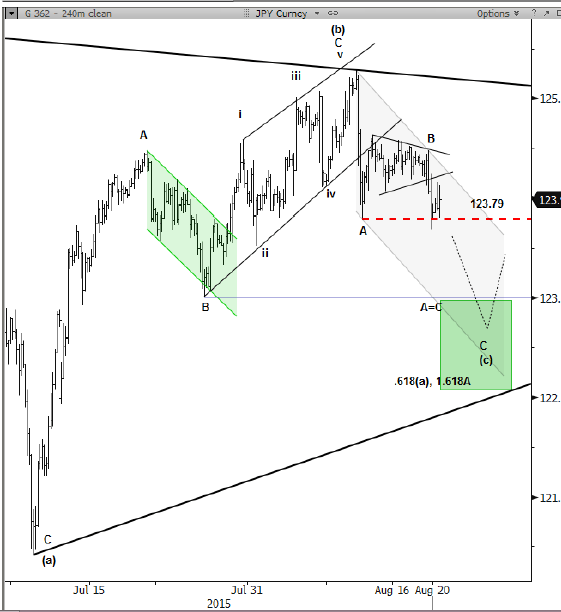

Nomura’s interpretation of the recent pullback in USD/JPY is that waves-(a) and (b) of a tightening triangle consolidation are complete, and now wave-(c) is targeting 123/122.

“The former is an old pivot low and A=C symmetry off the 125.28 high; the latter is a more aggressive extension and ideal triangle target,” Nomura clarifies.

Short-term, Nomura sees a close below 123.79 would clear a path to the proposed target zone a signal that wave-C of is unfolding. If shorts, Nomura advises lowering the stops to 124.25.

“Resistance is 124.16 and then critical at 124.47,” Nomura adds.

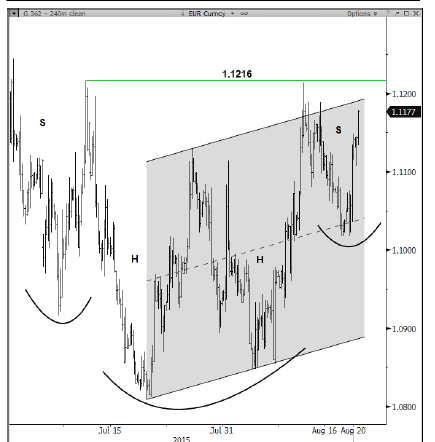

Turning to EUR/USD, Nomura notes that its price action has been difficult in terms of Elliott but there is a base forming from July below 1.1216.

“A clear breakout above 1.1216 would resolve a complex head & shoulders bottom. Above 1.1216 exposes the June high at 1.1436,” Nomura projects.

“S/t, pullback support is the latest correction at 1.1149/1107. Critical support below is 1.1018 as this is the low of a bullish engulfing candle pattern that formed with yesterday’s sharp rally,” Nomura adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.