Is EUR/USD finally making the break? We asked the question on Friday and the move higher eventually failed. But maybe after the first false move, we are now witnessing the real one?

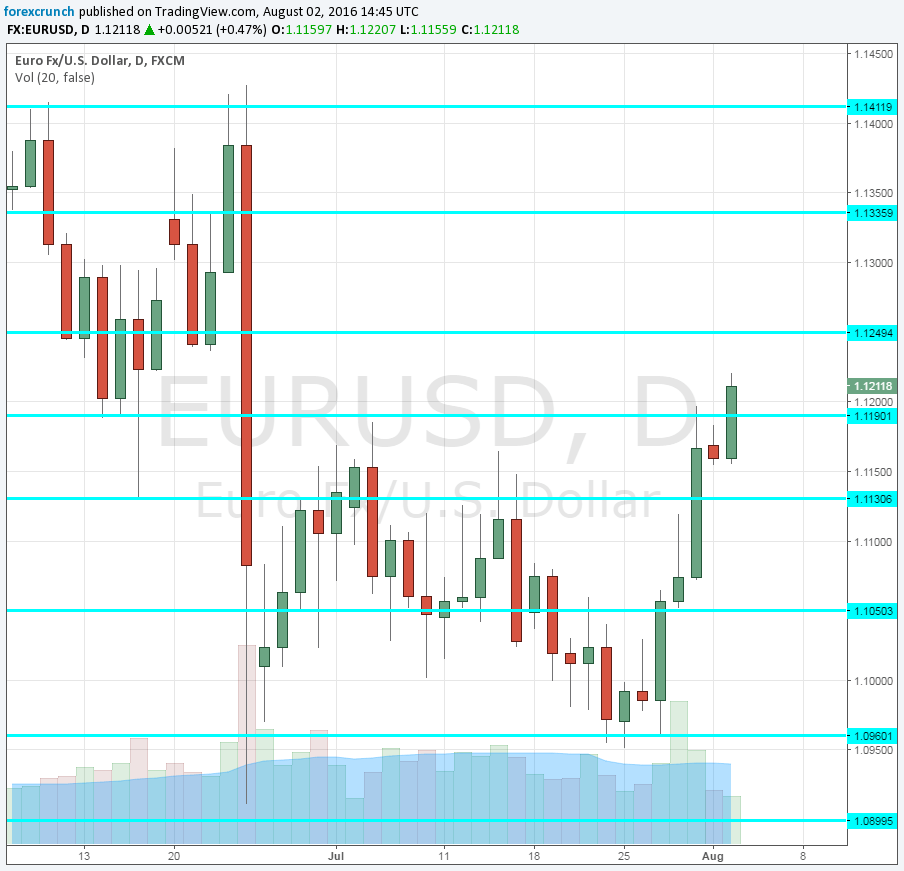

Euro/dollar is trading at 1.1212, above the 1.1190 that capped it in early July and was only temporarily broken at the dying hours of that month. The high so far is 1.1220. Resistance awaits at 1.1250.

What is behind the move? The dollar side of the equation has the answers. The greenback is sliding across the board. The most important release came on Friday with the very poor growth rate. The US economy grew far less than expected: only 1.2% annualized against 2.6% expected. A miss on the ISM Manufacturing PM and no real rise in inflation did not help either.

In Europe, the Producer Price Index beat expectations with 0.7%, but this is hardly a second-tier figure. More importantly, bad news about banks seems to have been marginalized. The EBA Stress Tests released on Friday did not reveal anything we hadn’t known, but they were probably good enough for markets.

Is this for real? Here is a rant about EUR/USD’s frustrating range trading.