After bringing you the preview from Danske and the one from Barclays, here is the preview by Goldman Sachs,

Another cut in the deposit rate cannot be ruled out:

Here is their view, courtesy of eFXnews:

Goldman Sachs expects the ECB to be on hold at its policy meeting on Thursday arguing that the meeting will be broadly dovish.

“Unlike the September ECB meeting, at which there was ‘no discussion’ of additional easing measures, it is possible that the ECB press conference hints that the Governing Council did discuss additional easing.

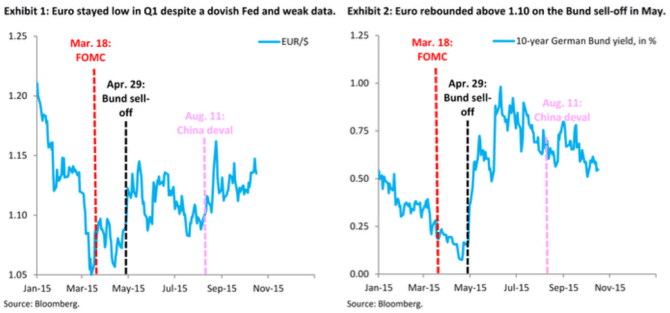

Given EUR/$ is above 1.13 in the top half of the recent range, with short positioning in EUR continuing to decline, and because the ECB is unlikely to want to encourage a stronger EUR from here, we continue to favour EUR/$ lower.

Should we get a surprise easing announcement, we would expect the EUR to trade lower, particularly in the scenarios of either an increase in the run-rate of QE or a cut to the deposit rate – by our estimates, a cut in the deposit rate of 10bp would be worth around 2 big figures in EUR/$,” GS projects.

“However, our base case is that the ECB would first opt for an extension of their current QE program beyond September 2016. Stepping up the pace of QE or cutting the deposit rate would likely only be in response to an intensification of external risks and / or a sharp move higher in the EUR.

As we wrote recently, we think that should the ECB signal their intention to keep bund yields stable, that is likely to reignite the portfolio rebalance channel – pushing investors out of Bunds into risky and foreign assets and weighing on EUR,” GS adds.

“The single most important task for President Draghi and the Governing Council is to clarify their message at coming ECB meetings. Even if there is no near term QE augmentation or deposit cut, a lot can be achieved simply by stabilizing bund yields at a reasonable level (again, what matters is stability foremost), much as the Fed or BoJ did from the start of their QE programs

And while base effects are really old news, we think the time to fix things is at one of the coming meetings, since headline inflation will jump once the December and January base effects come off. There is a need to fix ECB QE and the time to do that is now,” GS argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.