Euro dollar marked the borders of a low range and is leaning lower as more bad news exacerbate the debt crisis. The euro/dollar swap sends a warning signal about an upcoming credit crunch. European banks remain starved for money and sovereign yields remain at dangerous levels. Even Germany is criticized. When will the ECB finally act? Bond auctions are scheduled in Spain and France. Two major fresh US figures are released today.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

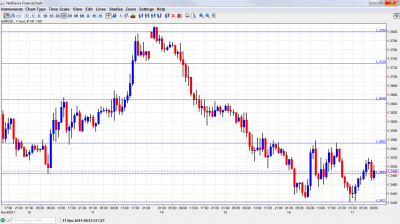

- Asian session:A relatively active session saw the pair slip towards 1.3420, rise again and falls resume now.

- Current range: 1.3420 to 1.3480.

- Further levels in both directions: Below 1.3420, 1.3360, 1.3250, 1.3145 and 1.30.

- Above: 1.3480, 1.3550, 1.3650, 1.3725, 1.38, 1.3838.

- Stronger resistance is now found at 1.3550 as the pair is lower.

- After 1.3480 was broken, 1.3430 is only weak support on the road lower, all the way to 1.3145.

Euro/Dollar erases recovery- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:30 Spanish bond auction. The country paid a high price recently.

- 10:00 French auction.

- 13:30 US Unemployment Claims. Exp. 396K. Very gradual improvement is seen here.

- 13:30 US Building Permits. Exp. 0.6 million.

- 13:30 US Housing Starts. Exp. 0.61 million.

- 15:00 US Philly Fed Manufacturing Index. Exp. 8.7 points. See how to trade this event with USD/JPY.

- 15:00 US Mortgage Delinquencies.

- 17:50 US FOMC member William Dudley talks.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Euro/dollar swap like in 2008: The cost of swapping euros to dollar’s continues rising, and shows that banks continue paying a dear price for dollars. This is a reminder of 2008 and very worrying for the whole system.

- Also Germany in trouble?: Jean-Claude Juncker, head of the euro-group, said that German debt levels are worrying, and that they are “larger than Spain”. Are there no safe havens left in the old continent?

- France wants stability from the ECB: More than one official speaker wants the ECB to “stabilize the situation. In other words: Help! The French/German spreads continue to widen.

- Spain needs aid?: German/Spanish spreads reached 460 basis points, just before elections are held in the euro-zone’s fourth largest country. There are reports that Spain’s designated prime minister, Mariano Rajoy, has negotiated €100 billion of aid with Angela Merkel. 10 year yields cross the 6.50% line.

- Italian trouble: The euro-zone’s third largest country delayed its GDP release. Does it have something to hide? The CEO of Unicredit, one the biggest banks, went to Frankfurt to meet with the ECB and ask for easier credit The ECB is buying Italian bonds, but not enough to send Italy back to sustainable lending levels. Remember that if the ECB doesn’t sterilize its bond buying, this is full QE, or euro printing, which can devalue the currency.

- No recession yet: The euro-zone didn’t enter a recession in Q3 according to the recent numbers, that came in line with expectations. It’s only important to note that the French economy contracted in Q2, contrary to no change initially reported.

- Yet more positive US figures: More good figures came out of the US: retail sales exceeded expectations while producer and consumer prices fell. The NY Fed Index and industrial production came above expectations. Today’s weekly jobless claims release and the Philly Fed index are important, as they both consist of fresh data for November.

- Political deadlock in the US: The debt ceiling is slowly creeping back. The November 23rd deadline for reaching a deal on long term debt reduction is getting closer, but the politicians are getting further away from each other. There’s only a week to go, and a failure might lead to a credit downgrade.