Euro dollar is settling in a lower range after the meetings that preceded the G-20 meetings made it clear that the Greek referendum will go through on December 4th/5th. Greece’s euro-membership is on the cards. Today we have the euro-zone first rate decision by Mario Draghi and quite a few important US events.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

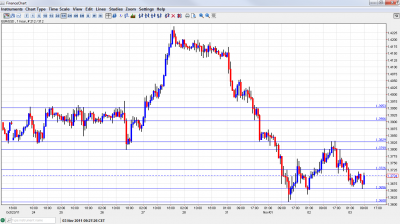

- Asian session: The pair fell to the 1.3650-1.3725 after Bernanke and remained there throughout the session.

- Current range: 1.3650 to 1.3725.

- Further levels in both directions: Below 1.3650, 1.36, 1.3550, 1.35, 1.3450, 1.3360, 1.3250.

- Above: 1.3725, 1.38, 1.3838, 1.39, 1.3950, 1.4050, 1.4130, 1.42, 1.4250, 1.4282.

- After 1.3650 was breached, 1.36 is the next cushion.

- Strong resistance is only at 1.3838. This was tested before Bernanke.

Euro/Dollar back in lower range – click on the graph to enlarge.

EUR/USD Fundamentals

- 12Ñ30 US Unemployment Claims. Exp. 401K.

- 12:30 US Non-Farm Productivity. Exp. +2.6%.

- 12:30 US Unit Labor Costs. Exp. -0.8%.

- 12:45 Euro-zone rate decision. Most expect an unchanged rate at 1.50%, but a cut of 0.25% is also possible.

- 13:30 ECB Press Conference with Mario Draghi. See the ECB Preview for all the details.

- 14:00 US ISM Non-Manufacturing PMI. Exp. 53.7 points. Last hit towards Non-Farm Payrolls.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greek Referendum is certain: The referendum will be held on December 4th or 5th and will actually be a question about Greece’s membership in the euro-zone. While it might be better for Greece and the euro-zone to separate, the initial shock for French banks might be very painful. As the question is on the euro and not on austerity, a Yes vote actually has a chance of winning and this episode may result only in a short delay. The market currently absorbs the shock although hinted in the past.

- G-20 Summit begins – Berslusconi doesn’t bring any news: Italy was pressured to make new reforms, regarding pensions and other issues. In the eve of the G-20 Summit which begins today, Italy’s PM didn’t succeed in getting an agreement within parliament. This adds to the pressure on Italian 10-year bond yields, which are rising again to 6.35%, despite ECB buying. Note that also short term yields are on the rise.

- Bad time to start for Draghi: After 8 years of Trichet, Italy’s Mario Draghi needs to make a decision between cutting the rates and helping the suffering economies and between building a strong reputation of an inflation fighter in the German-oriented ECB. With the membership of one euro-zone member in question at the time of the decision, his mission is very tough. Many expect no change for starters. A rate cut will hurt the euro. For all the factors and the implications for currencies, see the ECB preview.

- Bernanke doesn’t provide news: While the Fed is ready to act, Bernanke also said that the Fed has already done a lot and has been very aggressive. For a change, there has been one dovish dissenter from the decision. This helped the dollar improve positions, and the certainty of the Greek referendum pushed it even higher.

- Non-Farm Payrolls expected to be positive: If it weren’t for the Greek news, the focus would be on Friday’s Non-Farm Payrolls and the signs leading to it. Manufacturing PMI was OK, and ADP Non-Farm Payrolls exceeded expectations, but the biggest hint comes today from the largest sector: services. The employment component in this report is very important.