Euro/dollar managed to recover most of its losses last week, but the new week and new month begin with a fresh slide.

4 days are left until Greece needs to pay the IMF, and the sides are not getting any closer.

In an op-ed, Greek Prime Minister Alexis Tsipras sounded very defiant. He countered the positive words coming from Greek officials throughout the previous week. It seems that the IMF is on its back foot while perhaps some Europeans are willing to compromise, but there is also a lot of disinformation.

Another reason for euro weakness is the threat of Hungary being removed from the European Union due to a possible introduction of the death penalty.

At the moment, the common currency is ignoring good economic indicators: Spanish manufacturing PMI jumped to 55.8 points, well above expectations and the highest since 2007. In addition, the initial German inflation reads that were released are A-OK.

Later today we get more PMI data from other euro-zone countries and the US ISM Manufacturing PMI, which serves as the first hint towards Friday’s Non-Farm Payrolls.

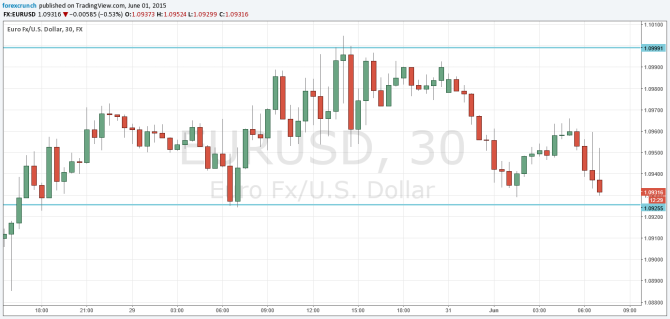

EUR/USD is down around 50 pips from 1.0983 to 1.0933. Weak support is found at 1.0910, followed by 1.0815, which was last week’s low. Clear resistance awaits at 1.10 and 1.1050.

Here is how it looks on the chart:

In our latest podcast, we discuss commodity currencies, oil hedging and preview next week’s events.