EUR/USD awaits developments in Greece after the dramatic referendum announcement. Looking at the wider picture, there aren’t reasons for EUR bulls to be very cheerful.

The team at Credit Suisse analyzes the situation and maintains its low target for the pair:

Here is their view, courtesy of eFXnews:

“In this context, the seemingly inconsistent behavior of the EUR stands out, with a kneejerk rally on Monday being more than reversed by a sharp sell-off after. For us, this is reflective of a theme, namely the EUR’s relatively new status as a funding currency,” CS argues.

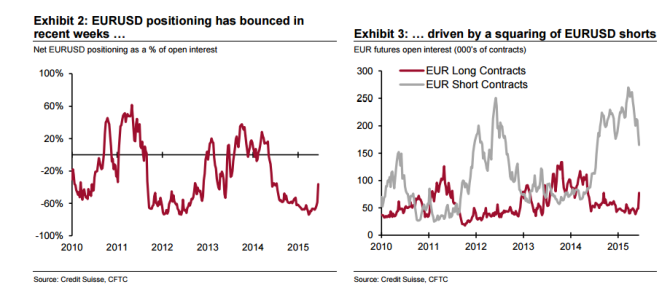

“In broad terms, the fact that the market had large short EUR / long carry positions on for some months before the Greek news flared meant that any sudden risk-off event on the back of bad news from Greece could have potentially led EUR much higher while position squaring accelerated,” CS clarifies.

“So the passage of Greek risk would actually remove a major impediment for holding or adding to EUR shorts. Similarly, even the idea of a knee-jerk pop higher for EUR on good news on the Greek front was a factor that arguably led investors to avoid short EUR positions until greater clarity was available and / or the “pop” had already happened. In this sense, EURUSD’s jump towards but failure to push beyond May’s highs near 1.1500 on Monday is an important signal,” CS argues.

On the other side of the coin, CS notes that US data continue to surprise positively, with housing data this week especially comforting.

“Our US economists still believe that the US economy has sufficient momentum to bring about a Fed rate hike in September, something rated as only 50:50 by the market,” CS adds

“Still, with euro area data also surprising to the upside, the argument for a rapid decline in EURUSD is not strong now, and we do not look for a break to new lows in the pair any time soon,” CS projects.

CS 3-month target for EUR/USD remains at 1.05.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.