- GBP/USD falls towards 1.3700 as fundamentals are not supportive of a stronger British pound.

- The employment and supply shortage problems are worse in the country, pushing the central bank to refrain from tightening.

- However, Delta spread in the US can weaken the Greenback and provide little support to the Pound.

The GBP/USD price analysis suggests a bearish continuation after the pair found rejection near the mid-1.37 mark amid weak fundamentals.

The GBP/USD pair is trading at 1.3707, down 0.13%, on Wednesday, at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The UK has a problem that can be summed up in two numbers. First, the economy lost 1 million jobs, and nearly 2 million people had to leave their jobs, retire, or go on vacation because of the pandemic.

The recent reports that UK restaurants and supermarkets have run out of stock could negatively affect the British Pound in the long run. As a result, it could delay a possible monetary tightening by the Bank of England.

McDonald’s, for example, announced Tuesday that it ran out of milkshakes and bottled beverages. Nando closed several stores last week due to chicken shortages, and the Co-op CEO said food shortages are the worst he has ever witnessed, including a shortage of truck drivers in the country.

In the short term, the Pound should not weaken. Still, any signal from the bank that it is concerned about a weaker than expected outlook for the UK economy could result in a significant depreciation of the currency, which is currently trading above the important level of 1.37.

Nevertheless, Germany and the United States are both facing difficulties. Following the spread of the Delta variant of Covid-19 and the decision to vaccinate all employees in the United States, Goldman Sachs altered its stance on employees returning to work. This was done to prevent employees from losing their jobs or working from home.

Bundestag elections on September 26 in Germany were under scrutiny after opinion polls showed the SPD had replaced Chancellor Angela Merkel as leader of the Christian Democrats (CDU).

Moving ahead, the market is awaiting US weekly unemployment claims, Prelim GDP q/q and Fed Chair Powell’s speech in the Jackosn Hole Symposium. These events have the potential to change the paradigm shift of the market.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

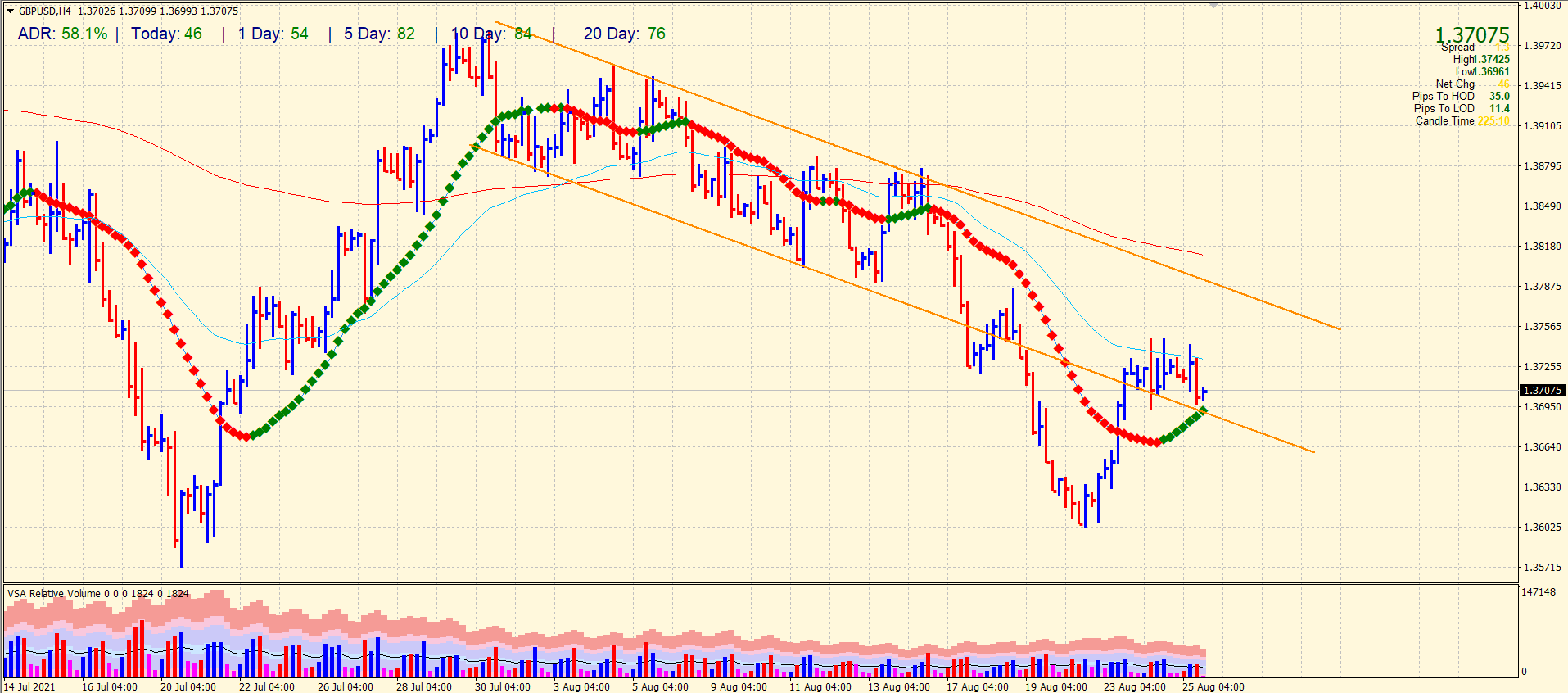

GBP/USD price technical analysis: Support confluence at 1.3700

The GBP/USD managed to move back into the trend channel and is now supported by the 1.3700 mark and the descending trend channel support. The pair has moved 58% of the average daily range so far as we are heading into the New York session. The price is also supported by the 20-period SMA on the 4- hour chart. However, the 50-period SMA provided stiff resistance. The pair has formed a hidden upthrust bar with a high volume. It indicates that the bears can take over the support zone and may test the next support area at 1.3660.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.