GBP/USD surged last week, gaining 1.5 percent. The pair briefly climbed above 1.35 line, for the first time since May 2018, before retreating. The upcoming week is very busy, with plenty of events to fit in before Christmas week. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

British GDP was a flat zero in September, as the economy continues to shows signs of weakness. Manufacturing Production rebounded with a gain of 0.2%, after back-to-back declines. The pound soared late in the week, as Prime Minister Boris Johnson won a resounding election victory, as the Conservatives sailed to an easy majority. This will allow Johnson to take the UK out of the EU by the end of January.

In the U.S., the Federal Reserve sent a dovish message to the markets, as the dot plots showed that most FOMC members did not anticipate a rate hike before 2021. CPI gained 0.3% and Core CPI rose 0.2%, as both were within expectations. Retail sales dipped to 0.2%, shy of the estimate of 0.5%. Core retail sales slowed to 0.1%, missing the forecast of 0.4%. On Thursday, there were reports that the U.S. and China had reached a limited trade agreement, which could signal the beginning of the end of the nasty trade war which has dampened global growth.

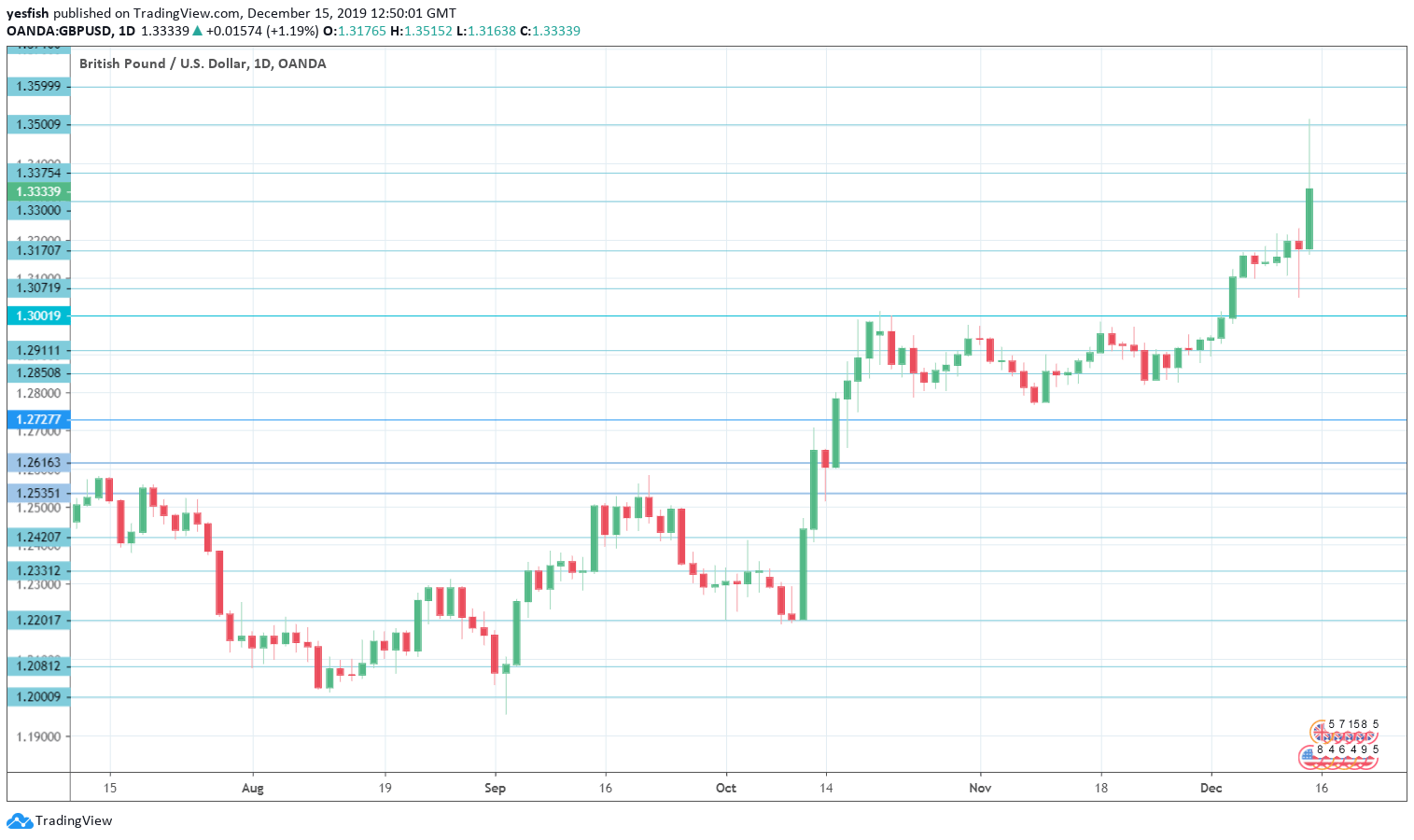

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Flash Manufacturing PMI: Tuesday, 9:30. The U.K. has added Flash PMIs releases, in addition to the Final PMI readings. The initial estimate for December is 49.1 pts. The second estimate for November came in at 48.9 pts.

- Flash Services PMI: Tuesday, 9:30. Final Services PMI for November dipped to 49.3, pointing to construction. The forecast for the initial estimate for December is 49.6 pts.

- BoE Financial Stability Report: Monday, 16:00. The Bank of England publishes its thorough report on financial stability twice a year. As well, the BOE also makes available some economic assessments which are relevant to monetary policy.

- Employment Reports: Tuesday, 9:30. Wage growth has dropped steadily since July, which showed a robust gain of 4.0%. The indicator fell to 3.6% in September, and the downtrend is expected to continue in October, with a forecast of 3.4%.

- Inflation Reports: Wednesday, 9:30. CPI has fallen since mid-2019, when inflation was around the 2 percent level. CPI dipped to. 1.5% in October, its lowest level since November 2016. An identical gain is projected in November. PPI Output, which has recorded three straight declines, is expected to post a weak gain of 0.1%.

- Retail Sales: Thursday, 9:30. Consumers have been wary to spend, with the dark cloud of Brexit and serious concerns about the economy. Retail sales haven’t posted gains since July. However, analysts expect a gain of 0.2% in the November release.

- BoE Rate Decision: Thursday, 12:00. At the November rate meeting, two MPC members voted to immediately lower rates, while seven members voted to leave the benchmark rate at 0.75%. Analysts expect the vote breakdown at the December meeting to be identical. As for the QE program, members are expected to vote unanimously to maintain the program at 435 billion pounds.

- GfK Consumer Confidence: Friday, 0:01. Consumers remain pessimistic about economic conditions in the U.K. The indicator has hovered at -14 pts for the past two months, and the same reading is expected in December.

- Current Account: Friday, 9:30. The U.K. continues to record current account deficits. In Q2, the deficit narrowed to GBP -25.2 billion, but this was considerably larger than the deficit of -19.2 billion. The deficit is expected to narrow again in Q3, with an estimate of -15.5 billion.

- Final GDP: Friday, 9:30 The British economy posted a decline of 0.2% in Q2, but a rebound is expected in Q3, with a forecast of +0.3%.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start at 1.3710, which has held in resistance since May 2018.

Below, 1.3615 capped the pair in late 2017.

The round number of 1.3500 is next.

1.3375 was tested last week and is an immediate resistance line.

1.3217 is the first line of support. 1.3170 is next.

1.3070 was a high point in November 2018.

The round number of 1.3000 (mentioned last week) is the final line for now.

I am bullish on GBP/USD

The decisive election win by the Conservatives should pave the way for the UK to leave the EU next month, after years of uncertainty surrounding Brexit. The pound posted sharp gains last week and could pad these gains this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!