GBP/USD ticked up a bit in the first week of 2018, enjoying the weakness of the dollar. Manufacturing output and the trade balance stand out in the upcoming week. Here are the key events and an updated technical analysis for GBP/USD.

Both the manufacturing and construction PMIs missed expectations, showing a potential for a slowdown. However, the services sector, which is the largest one, showed stability according to the PMI. In the US, the greenback drifted lower despite better than expected data and a balanced FOMC meeting minutes report.

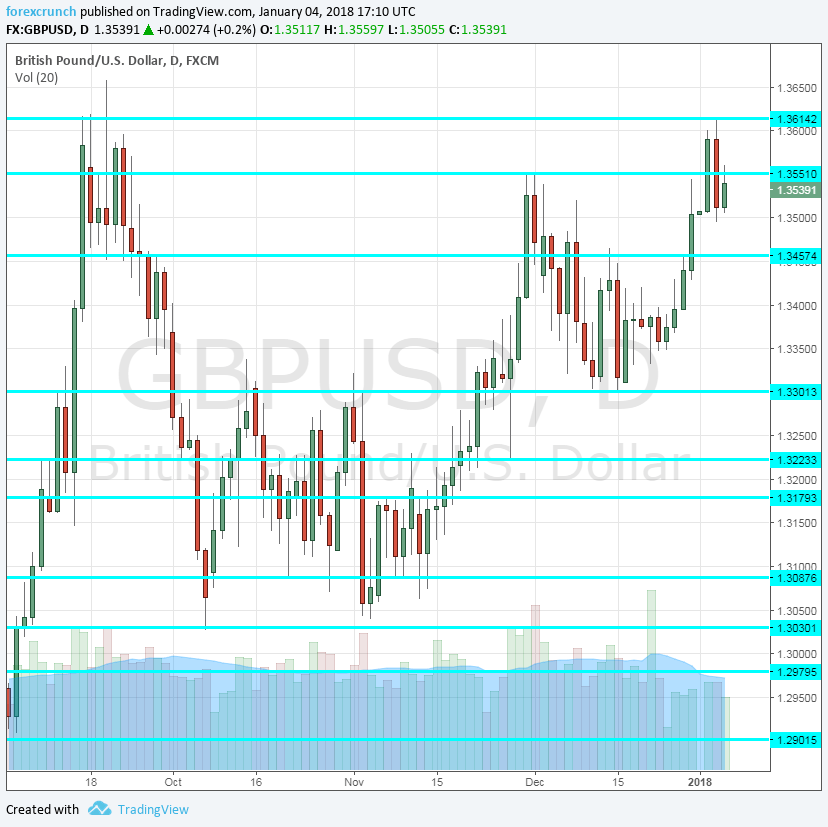

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Halifax HPI: Monday, 8:30. This highly-regarded measure of house prices beat expectations with a gain of 0.5% in November, extending the series of consecutive gains that began in July. A small rise of 0.2% is expected.

- BRC Retail Sales Monitor: Tuesday, 00:01. The British Retail Consortium’s gauge of retail sales advanced by 0.6% y/y in the data published for November, after a fall beforehand. We will now see the level of same-store sales change for December, the month of Christmas shopping.

- Manufacturing Production: Wednesday, 9:30. Manufacturing enjoys the weaker value of the pound that makes exports more competitive. Back in October, production increased by 0.1% and a 0.3% increase is projected now. The wider industrial output remained flat and is now forecast to rise by 0.4%.

- Goods Trade Balance: Wednesday, 9:30. In the past two releases, there was a surprising narrowing in the trade deficit, reaching 10.8 billion in October. Will it fall to single digits now? Expectations point to the other direction: a deficit of 11 billion.

- Construction Output: Wednesday, 9:30. Contrary to the manufacturing sector, the construction one has been squeezing. A drop of 1.7% was seen in October, the second drop in a row. An increase of 0.5% is predicted.

- NIESR GDP Estimate: Wednesday, 13:00. The National Institute of Economic and Social Research publishes its estimate for GDP growth in the past three months. In the three months ending in November, NIESR showed a rise of 0.5%. We will now get the data for the whole of Q4, ahead of the official release.

- BOE Credit Conditions Survey: Thursday, 9:30. This quarterly report about credit conditions provides an assessment of activity in the economy. In the report for Q3 showed a slight increase in the availability of credit.

BP/USD Technical Analysis

Pound/dollar made a move towards the 1.3615 level (mentioned last week) but didn’t manage to break that line. It then drifted back down to range.

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.3550 was the November peak.

1.3460 capped the pair in mid-December and serves as resistance. The round level of 1.33 is a key level of support, working as such around the same period of time.

1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

1.3080 worked as support in mid-October and also was weak support during November. 1.3030 is the bottom of the range, cushioning cable in October and also in early November.

I remain bearish on GBP/USD

Once again, the pound enjoyed the weakness of the dollar more than its own strength, but this was only enough to hold its ground. We could see some reckoning now.

Our latest podcast is titled Wages not winning, tax cuts to cut it?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!