GBP/USD fell by 1.0% last week, wiping out the gains of the previous week. There are six events in the upcoming week, with investors focused on PMI reports. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The Brexit saga took a major twist last week, as Prime Minister Boris Johnson stunned lawmakers and the nation by suspending parliament. The move, which takes effect next week, means that parliament will have just three weeks to pass legislation with regard to Brexit prior to the withdrawal date on October 30. The suspension drew outrage across the country and has increased the likelihood of a general election in the near future. At the same time, the Brexit negotiations are at a standstill, and there is a strong possibility that the U.K. could leave without an agreement in place. Such a scenario could send the pound sharply lower.

In the U.S., the highlight of the week was second-estimate GDP for Q2, which came in at 2.0%, matching the estimate. This was a slight downward revision from initial estimate, which came in at 2.1%. It is evident that second-quarter growth will be significantly weaker than Q1, and further rate cuts could be in the works in the remainder of 2019. Durable goods orders improved to 2.1%, up from 2.0% a month earlier. However, core durable goods orders declined by 0.4%, the first decline in six months. The week wrapped up with UoM consumer confidence, which dropped sharply to 89.8 in July, down from 98.4 in June. This marked the first time that the key confidence indicator has dropped below the 90-level since October 2014.

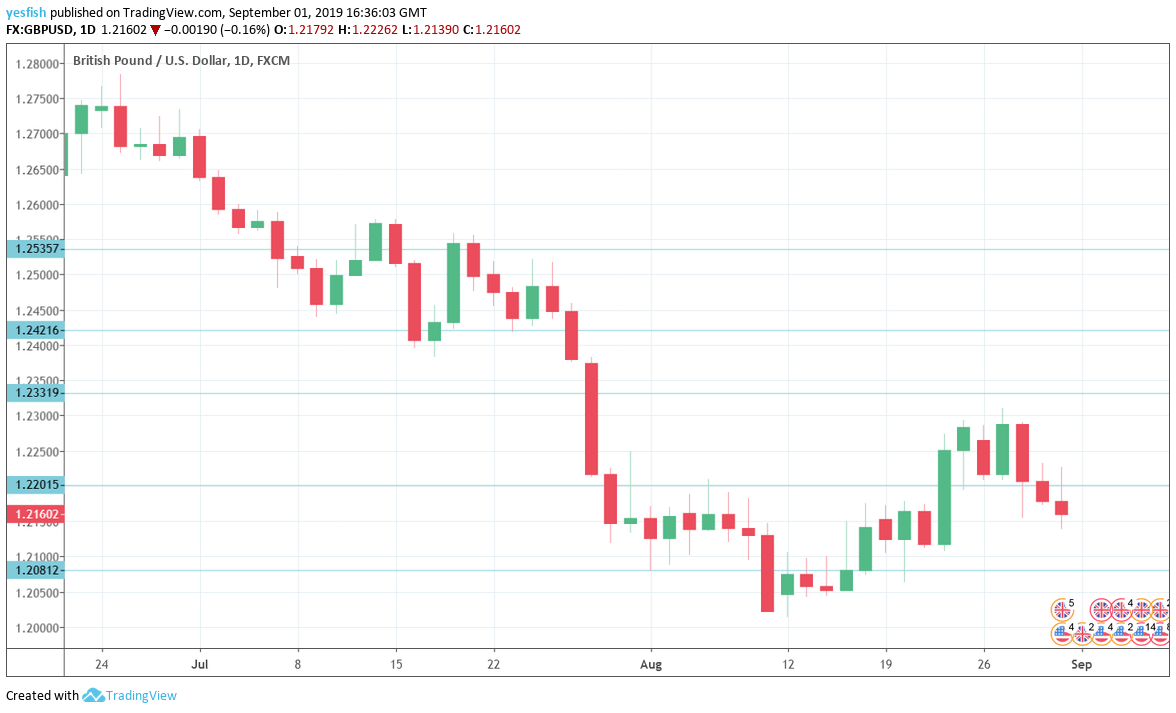

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The British manufacturing sector remains weak, and the PMI has pointed to contraction for three straight months. The index came in at 48.0 in July and no change is expected in the August release.

- BRC Retail Sales Monitor: Monday, 23:01. This consumer spending indicator posted a small gain of 0.1% in July, after two straight declines. Another gain of 0.1% is expected in August.

- Construction PMI: Tuesday, 8:30. The construction industry is in a state of contraction, with the PMI below the 50-level in five of the past six months. This situation is expected to continue, with a forecast of 46.7.

- Services PMI: Wednesday, 8:30. The services sector is also limping, with recent readings just above the 50-level, which means stagnation. In July, the PMI came in at 51.4, and the index is projected to slow to 51.0 in August.

- Halifax HPI: Friday, 7:30. The Halifax Bank of Scotland pointed to a decrease in the past two readings. The markets are expecting an improvement in August, with an estimate of 0.5%.

- Consumer Inflation Expectations: Friday, 8:30. The Bank of England’s survey of 2,000 consumers has been steady, ticking lower to 3.1% in Q1, after showing a gain of 3.2% in the previous two quarters. No significant change is expected in Q2.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2535. This line has held since mid-July. This is followed by 1.2420.

1.2330 (mentioned last week) has held in resistance since the end of July.

The round number of 1.22 switched to resistance in mid-week following sharp losses by GBP/USD.

1.2080 is the first support level.

The round number of 1.20 follows.

1.1943 is next.

1.1904 was the low point in October 2016.

The round line of 1.1800 is the final line for now.

I am bearish on GBP/USD

The suspension of parliament sent shock waves across the U.K, but in truth the Brexit woes run much deeper, and it’s difficult to see how the EU and the Johnson government will overcome their differences and reach a withdrawal deal. The uncertainty surrounding Brexit could mean further headwinds for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!