- Over the past three months, the pound has fallen by more than 6% against the US dollar.

- Money markets are pricing in no further BoE rate hikes.

- British retailers reported their worst October for sales volumes on record.

Friday’s GBP/USD outlook is pessimistic as bearish sentiment persists near three-week lows amid dampened BoE rate hike expectations. Recently, economic data has reinforced the expectation that the Bank of England will hold rates unchanged at its upcoming policy meeting.

-Are you interested in learning about the forex signals telegram group? Click here for details-

According to Kirstine Kundby-Nielsen, an analyst at Danske Bank, the pound’s recent decline can be attributed to the BoE’s dovish comments. Moreover, there has been weaker-than-expected UK data and a growing market consensus that another rate hike is unlikely.

Notably, the pound has fallen by more than 6% over the past three months against the US dollar.

Meanwhile, data from Tuesday revealed a loosening labor market. Moreover, the flash reading of the S&P Global UK Purchasing Managers’ Index (PMI) for the services sector dropped to 49.2 in October. There was unexpected stability in September’s inflation at 6.7%, the highest among major advanced economies. However, the BoE is widely expected to maintain rates at 5.25% on November 2.

Currently, money markets are pricing in no further rate hikes and are even considering rate cuts as early as June next year. Last Friday, BoE Governor Andrew Bailey stated that September’s inflation data was close to the central bank’s expectations.

Further underscoring the economic challenges, British retailers reported their worst October for sales volumes on record. Moreover, they anticipate another tough month in November. This decline came as households grappled with the rising cost of living.

GBP/USD key events today

The US will release a significant inflation report comprising the following:

- Core PCE Price Index (MoM)

- Core PCE Price Index (YoY)

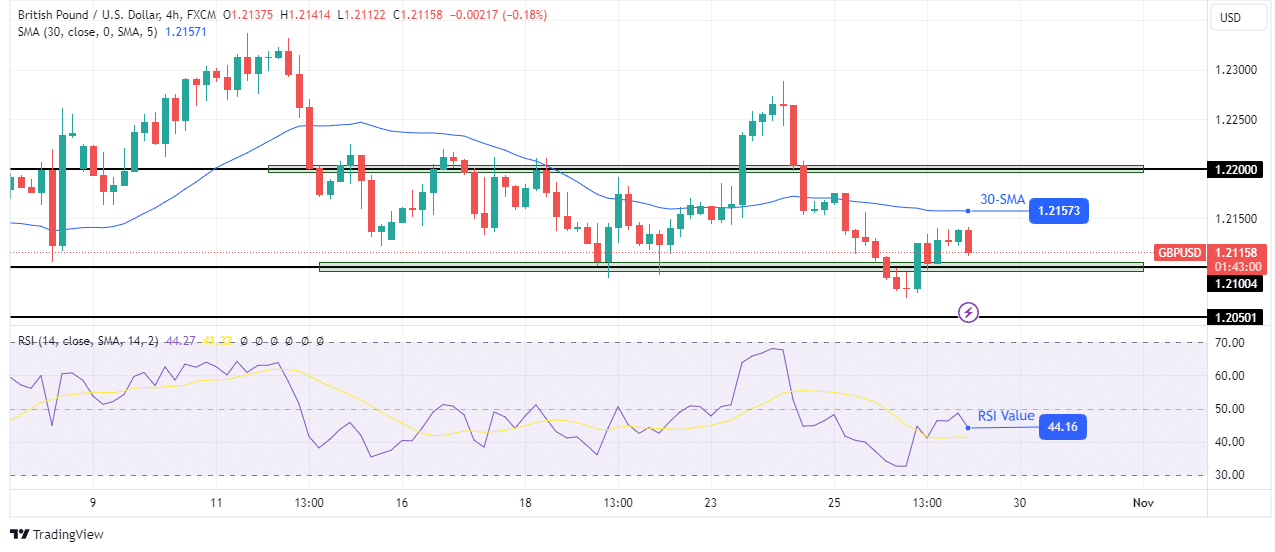

GBP/USD technical outlook: Price hits a new low below 1.2100.

The bias for GBP/USD on the 4-hour chart is bearish as the price made a lower low when it breached the 1.2100 key level. Although it has pulled back to trade above 1.2100, the bias remains strong as the price is below the 30-SMA.

-Are you interested in learning about forex indicators? Click here for details-

Additionally, the RSI shows strong bearish momentum trading below 50. Bears look prepared to continue the downtrend by retesting the 1.2100 support. A break below this support would push the price to retest the 1.2050 support, making a lower low.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money