- Investors anticipate a swift transition to US rate cuts in 2024.

- Sterling has surged nearly 4% against the dollar this month.

- Sunak disclosed £29.5 billion ($36.76 billion) in private-sector investments in Britain on Monday.

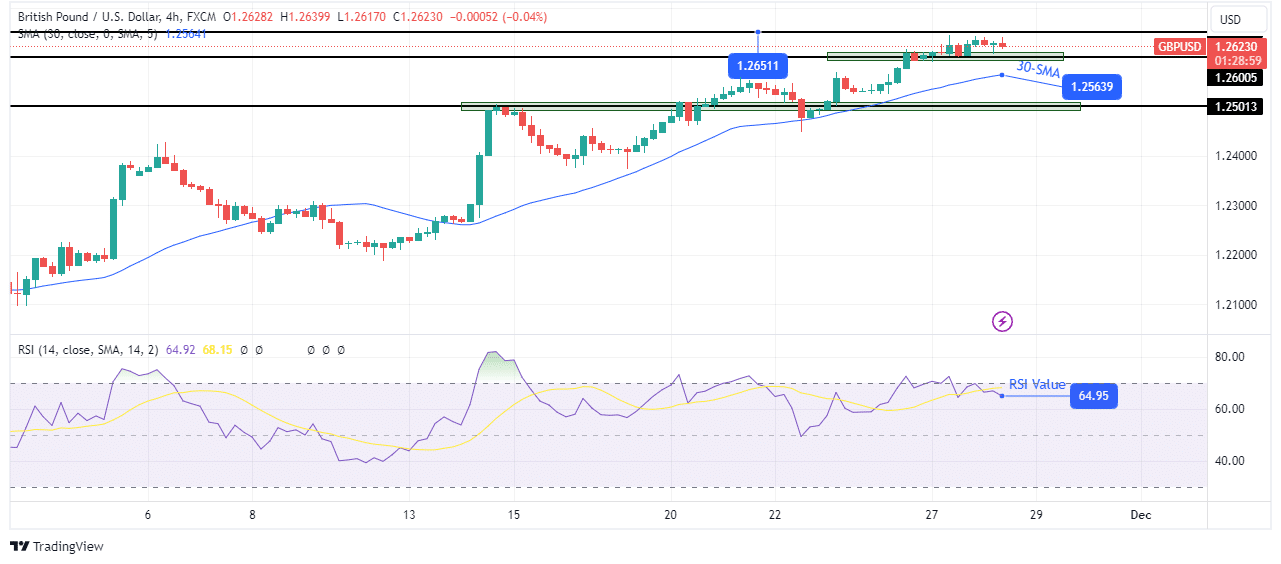

On Tuesday, the GBP/USD outlook shone with bullish optimism, remaining above the key mark of 1.2600 as the Greenback stayed weaker. It’s on the brink of achieving its most remarkable monthly surge against the dollar in the past year. Notably, investors are abandoning the dollar, anticipating a quick transition to Fed rate cuts in 2024.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

In a potentially beneficial development for the pound’s long-term outlook, Prime Minister Rishi Sunak unveiled a series of foreign investments in Britain ahead of a business leaders’ gathering. The pound has risen nearly 4% against the dollar this month. Moreover, it is on course for its first monthly gain since June.

Meanwhile, money market traders predict that the Bank of England will maintain higher interest rates for longer than the Fed in 2024. Consequently, this outlook has contributed to the pound’s recent rally. Just under two weeks ago, traders had factored in approximately 70 basis points in UK rate cuts for next year. However, after recent data releases, including business activity and inflation, this expectation has adjusted to around 60 bps.

BoE Governor Andrew Bailey, in a Monday interview, remarked that achieving the central bank’s 2% inflation target will be challenging. Furthermore, he attributed the recent decline in inflation to the correction of last year’s surge in energy costs.

Concurrently, UK Prime Minister Rishi Sunak will host global executives outside London this week to restore the country as Europe’s leading foreign direct investment (FDI) destination.

GBP/USD key events today

- The US Conference Board consumer confidence report

GBP/USD technical outlook: Bulls find their feet above the 1.2600 key level

Bulls are charging ahead on the charts, making new highs above the 30-SMA. The bullish bias is strong, and the price is currently bouncing higher after breaking above the 1.2600 resistance level. Therefore, bulls will likely soon exceed the 1.2651 level.

–Are you interested to learn about forex robots? Check our detailed guide-

However, after a big swing away from the 30-SMA, the price usually pauses or retraces the upward move. Therefore, we could see bears return for a pullback. Moreover, bullish momentum is near an extreme level, with the RSI nearly overbought. Still, a pullback would only be a short pause in the uptrend unless the price breaks below the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.