- The pound bull rally continues amid dollar weakness.

- China will maintain its strict COVID-19 policy, which might affect the global economy.

- Britain’s economic outlook remains bleak as it heads for recession.

Today’s GBP/USD outlook is bullish. The Sterling increased on Monday, mostly due to a weaker dollar. This helped the pair return to its previous levels before the Bank of England (BoE) announced its largest interest rate increase in three decades.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The dollar initially ticked up following China’s announcement that it would maintain a strict COVID-19 containment policy, news that initially caused investors to rush to the safe-haven dollar. However, soon after, the pound increased as the dollar declined.

“The market seems to have rather easily shrugged off the weekend denials from China that zero-covid may soon be over and continued with the momentum from last week. The dollar softening due to increased bets (misplaced, in my view) that the Fed will soon pivot to a more dovish stance,” Michael Brown, head of market intelligence at Caxton, said.

The pound is trading where it was before the Bank of England’s decision to increase its benchmark interest rate by 75 basis points on Thursday as it works to reduce double-digit inflation. Analysts, though, are still pessimistic about the currency’s prospects given the state of the economy.

The BoE’s decision caused the pound to drop as much as 2% and included a warning that Britain could be in for its deepest recession in at least a century. The central bank also stated that borrowing costs might not rise as dramatically as some anticipate.

GBP/USD key events today

Bank of England Monetary Policy Committee (MPC) member Pill is set to speak later today, and investors will be keen on any clues on future monetary policy.

GBP/USD technical outlook: Upside potential remains

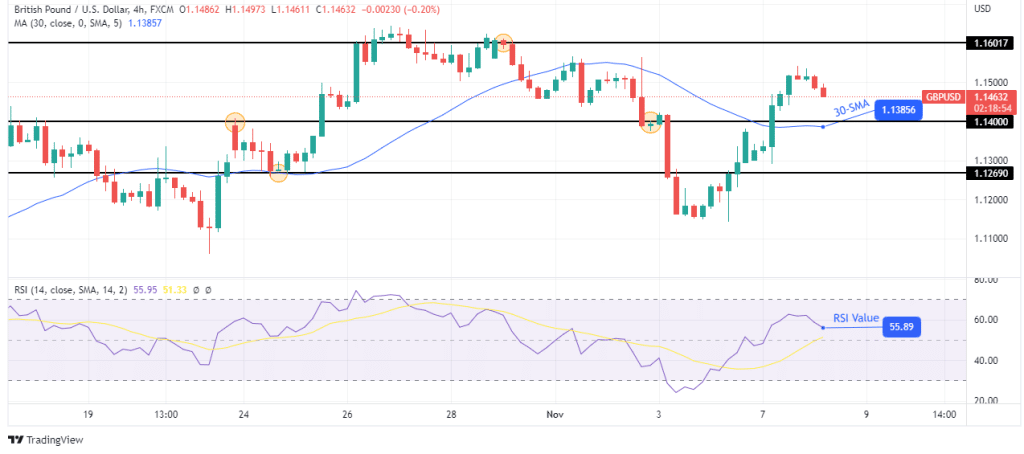

Looking at the 4-hour chart, we see the price trading above the 30-SMA and the RSI above 50, showing bulls are in charge. The price currently trades between the 1.1400 support and the 1.1601 resistance levels.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

At the moment, bears have returned to retrace the recent bullish move. This could mean a retest of 1.1400. The bullish trend will likely continue after the retracement if the price stays above the 30-SMA. If bulls can maintain their control, the price will retest 1.1601 and possibly break above.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.