- GBP/USD bears have appeared back after the price found rejection at 1.3700.

- BoE is expected to keep rates unchanged at 0.1% as the probability by the CME BOEWatch tool is now 55%.

- Brexit concerns with Ireland and France remain a cause for bearish pressure on the pound.

The GBP/USD price analysis reveals a rangebound behavior after the Fed meeting last night. The gains were followed back by the losses. Hence, the GBP/USD pair is back to square one and awaits the BoE rate decision today.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started.

Despite a powerful Fed-driven rebound from nearly three weekly lows at 1.3606, the GBP/USD price continued its recent downtrend on Super Thursday.

Following Fed disappointment on Wednesday, the bears have tried to take back control of the pound sterling as speculation about an impending rate hike by the BOE has died.

Chairman Jerome Powell said the Fed will be patient with rate hikes until it reaches the maximum employment target before trimming bond purchases by $15 billion a month. A change in wording regarding inflation was also made, stating that “temporarily expected” price pressures are to rise.

CME BOEWatch indicates a 55% chance that the Bank of England will raise interest rates at its November meeting. While the Bank of England continues to assess inflation and Brexit risks, this could be a big wake-up call for its policymakers.

The Northern Ireland Protocol (NI) remains a source of tension between the European Union (EU) and the United Kingdom.

As EU Vice President Frans Timmermans put it, it was “very well known” in London that the European Court of Justice (ECJ) waiver request would not be granted.

Lord Frost, Britain’s Brexit Minister, stated that the European Court of Justice should be replaced by an independent arbitral tribunal. It cannot play a role in resolving Northern Ireland disputes.

A major obstacle to the pound remains the British-French disagreement over fishing rights after Brexit. As a result, traders are now preparing for the Bank of England’s decision regarding the currency pair’s direction in the future. There will also be attention focused on the Brexit talks in Paris and the weekly US jobless claims.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

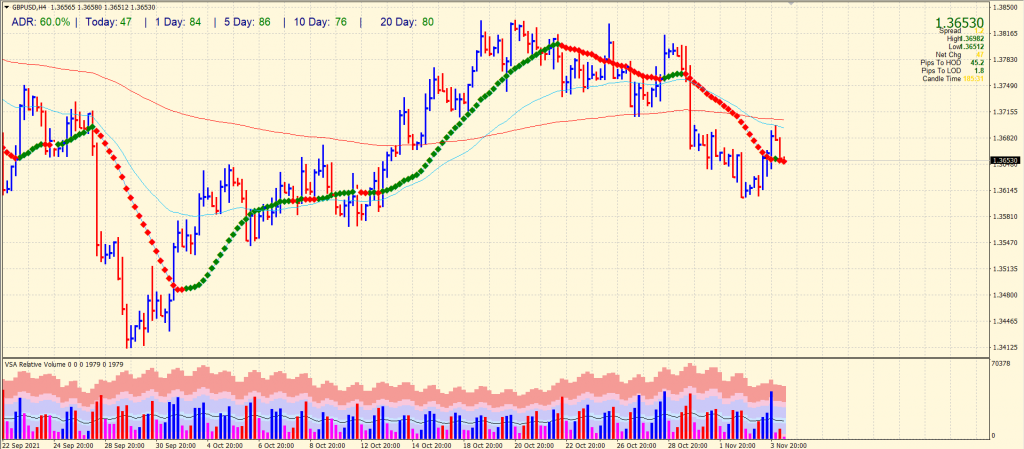

GBP/USD price technical analysis: Locked between 1.36 – 1.37

The GBP/USD price pared off overnight gains and found rejection near the 1.3700 area. The pair fell back to the 1.3650 area. However, the 20-period SMA on the 4-hour chart provides support for now. The average daily range is 57% so far which shows high volatility for the day. The volume data shows a bullish bias as the volume declined with a fall in price from 1.3700. Technically, the pair is locked between 1.3600 and 1.3700, and range breakout will determine the next trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.