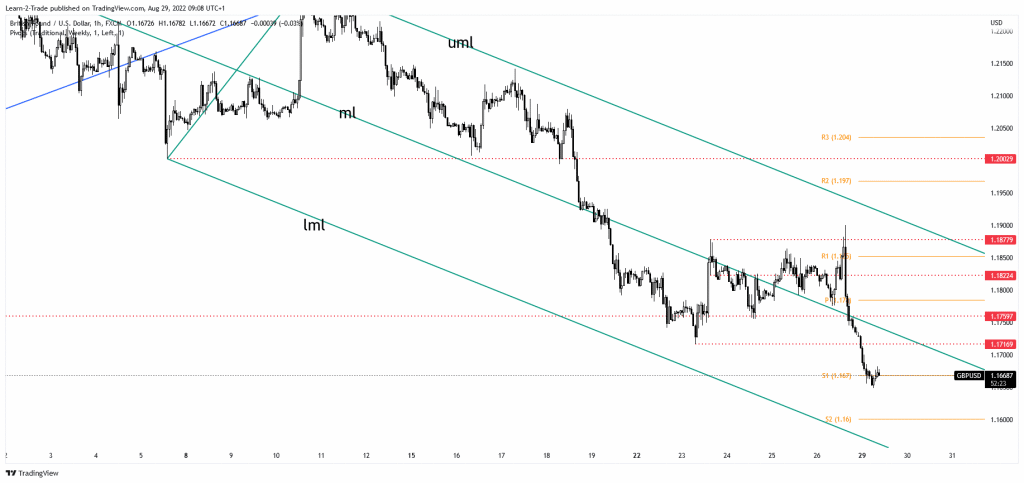

- The GBP/USD pair maintains a bearish bias as long as it stays below the median line (ml).

- The S2 is seen as an important downside target.

- Its false breakout above the former high confirmed that the rebound ended.

The GBP/USD price crashed after failing to modestly recover ground. It was trading at 1.1665 at the time of writing. It seems quite pressured by the bears.

-Are you interested in learning about the forex indicators? Click here for details-

The USD took the lead and dragged the price down as the Dollar Index ended its minor correction after reaching new highs. Today, the UK banks will be closed. Only the FOMC Member Brainard could bring life to the GBP/USD pair.

Tomorrow, the M4 Money Supply, Mortgage Approvals, and Net Lending to Individuals could bring some action. Still, the US JOLTS Job Openings and the CB Consumer Confidence data could be decisive as the indicators are high-impact.

Dollar Index Price Technical Analysis: Key resistance at 109.29

The Dollar Index retreated a little after its strong growth. The short-term drop was natural before extending its upwards movement. It remains bullish as the Federal Reserve is expected to continue hiking rates. A 50bps hike is expected in September. That’s why the index is strongly bullish.

As you can see on the hourly chart, the DXY found support on the ascending pitchfork’s median line (ml), which now challenges the 109.29 static resistance. A valid breakout may confirm further growth. This scenario could help us to catch new USD longs.

GBP/USD Price Technical Analysis: No respite for bulls

The GBP/USD pair registered only a false breakout above 1.1877, signaling a fakeout and triggering a fresh selling wave. Now, it has ignored the median line (ml) and the 1.1716 downside obstacles confirming a downside continuation.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

After its massive drop, we cannot exclude the probability of a temporary rebound. The price could come back to test the 1.1700 psychological level and the median line (ml) before extending its drop.

The weekly S1 (1.1670) represented a potential downside target. Stabilizing below this level could activate more declines towards the weekly S2 (1.1600). Also, as long as it stays under the median line (ml), the GBP/USD pair could also approach and reach the lower median line (LML).

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.